Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Wednesday, December 18, 2019

e-KYC likely to be Aadhaar for non-banks

Star Wars: The Rise of Skywalker - Our Spoiler-Free Review

MyShake, an app that uses data from the USGS alert system to sense earthquakes, sent out its first public alert for a 4.3 earthquake on Tuesday (Los Angeles Times)

Los Angeles Times:

MyShake, an app that uses data from the USGS alert system to sense earthquakes, sent out its first public alert for a 4.3 earthquake on Tuesday — In a milestone, California's new statewide earthquake early warning cellphone app sent out its first public alert for a magnitude 4.3 earthquake …

Dunzo, Throttle get nod to test long-range drones

Oyo likely to lay off 2,000 people by February

Snapdeal founders summoned in 'fake' HUL products case

The SEC wants to expand on who is allowed to invest in private securities

As the number of privately held companies continues to grow — and privately held companies stay private longer than ever — public market shareholders who’d earlier benefited from the growth of companies like Google and Amazon are missing out, fears the Securities & Exchange Commission.

It wants to do something about it, too.

Toward that end, the agency today proposed amendments to the definition of “accredited investor” and the definition of “qualified institutional buyer” that would expand the list of people and institutions currently capable of investing in the private capital markets — meaning startups, hedge funds, venture funds and private equity funds.

What would change? Right now, as the SEC defines accredited investors, a person has to have at least $1 million in liquid assets and $200,000 in annual income.

The SEC’s new proposal would enable investors with an entry-level stockbroker’s license or other credentials issued by an accredited educational institution to invest in private securities; “knowledgeable” employees of funds who might not currently meet the SEC’s wealth thresholds; family offices with at least $5 million in assets under management and their family clients; and “spousal equivalents” who could pool their assets for the purposes of qualifying as accredited investors.

The proposed amendments would also add limited liability companies and RBICs to the types of entities that are eligible for qualified institutional buyer status if they meet the $100 million in securities owned and investment threshold in the definition. And the SEC wants to add a new category for any entity, including Indian tribes, that owns “investments,” as defined in Rule 2a51-1(b) under the Investment Company Act, that are valued at more than $5 million and that weren’t formed for the specific purpose of investing in the securities offered.

The proposal is now open to a 60-day comment period. In the meantime, expect there to be strong arguments both for and against the SEC’s moves to expand the private investing pool.

On the one hand, parties focused on investor protection will surely argue that vulnerable investors will be taken advantage of by startups that already have access to more than enough capital (especially startups worth funding). On the other side, expect to hear from the growing number of voices concerned that mom and pop investors have been shut out of American’s innovation economy, and that income inequality is worsening quickly because of it.

You can check out the SEC’s specific proposals here, as well as find instructions on where to submit a comment.

Goldman Sachs leads $15M investment in Indian fintech startup ZestMoney

One of America’s largest banks has just poured some money to help millions of Indians without a credit score secure loans and make purchases online for the first time in their lives.

Bangalore-based ZestMoney announced today it has raised $15 million from Goldman Sachs and existing investors Naspers Fintech, Quona Capital, and Omidyar Network. Lizzie Chapman, co-founder and chief executive of ZestMoney, told TechCrunch in an interview that the new investment is part of an extended Series B round, the first tranche of which it announced in April this year.

The extended Series B round brings ZestMoney’s total raise to-date to $63 million, she said.

The penetration of credit cards remains very low in India; roughly three in 100 people in the country have a credit card. This has meant that very few people in the nation have a traditional credit score, which banks heavily rely on to establish one’s credit worthiness before issuing them a loan.

Moreover, small loans don’t generate lucrative returns for banks, giving them less incentive to write such cheques. In recent years, a growing number of Indian startups has stepped in to address this void.

ZestMoney assesses other data points and uses AI to help these people build a profile and become credit-worthy. The startup has partnered with over 3,000 merchants (up from some 800 in late April), including Flipkart, Amazon, and Paytm, to offer financing options at point-of-sale.

It has amassed more than 6 million users, who can access credit of $140 to $3,000. To make the deal even better, many of these merchants offer interest-free option to customers, provided they could pay back in a specified amount of time.

The startup, which has partnership with nearly every online payments processor including Razorpay, BillDesk, Cashfree, CCAvenue, and PayU, has also made a push in the brick and mortar market by inking deals with Chinese smartphone maker Xiaomi, and Pine Labs, which has over 300,000 point-of-sale machines across the country.

ZestMoney has also raised an unspecified amount of debt, which it uses to finance credit to customers. It recently entered in a strategic partnership with Credit Saison, a Japanese financial services company affiliated to Mizuho Financial Group, to deploy $100 million towards expanding digital lending in the country.

Philip Aldis, a managing director at Goldman Sachs, said its investment in ZestMoney would enable more households in India to access credit. “We look forward to leveraging our global experience and network for the continued growth of ZestMoney,” he said in a statement.

Goldman Sachs has invested in a handful of startups in India, including logistics startup BlackBuck, home rental platform NextAway, news aggregator DailyHunt, and online furniture store PepperFry.

The New York-headquartered firm, which is one of the world’s largest trading banks, has also invested in a number of financial startups including NuBank, a Brazilian startup that offers digital credit card to smartphone users. It is also the banking partner for Apple Card.

ZestMoney aims to disburse credit of worth $1 billion in 18 months and reach 300 million users one day.

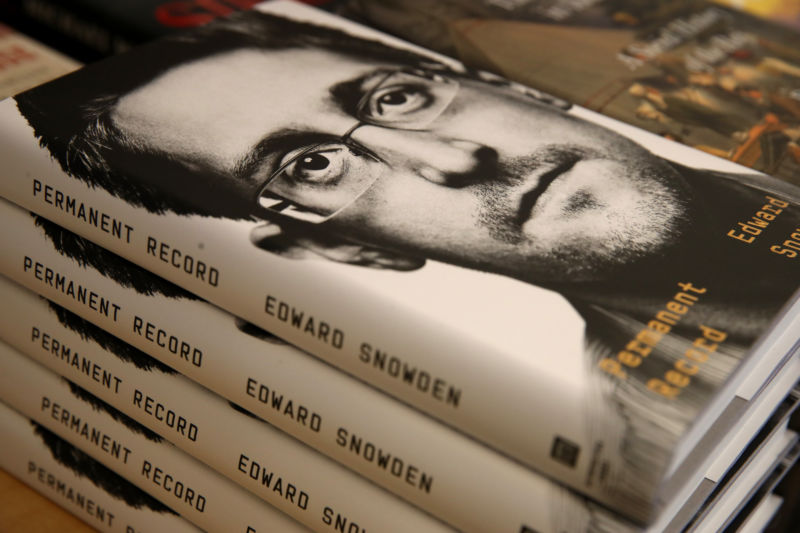

US government is entitled to all Snowden book proceeds, judge rules

Enlarge (credit: Justin Sullivan/Getty Images)

The US government is entitled to every cent Edward Snowden earns from publishing his memoir, Permanent Record, a federal judge ruled on Tuesday. During his employment at the CIA and NSA, Snowden signed contracts promising to seek pre-clearance from those agencies before publishing any book or other publication containing classified materials. If he failed to do so, the contracts said, Snowden would forfeit any proceeds to the federal government.

Snowden is still in exile in Russia, where he has been stranded since 2013. The classified documents Snowden leaked to multiple journalists that year sparked an intense debate over US surveillance practices and inspired some modest reforms. Snowden faces near-certain prosecution for espionage if he returns to the US.

The US Department of Justice filed a lawsuit on September 17, the day Snowden's book first went on sale, seeking to seize Snowden's book profits. On Tuesday, just three months later, Judge Liam O'Grady granted the government's motion for summary judgment.

Boston-based OM1, a healthcare industry startup which organizes and analyzes large datasets to measure and predict clinical outcomes, raises $50M Series C (Dave Muoio/MobiHealthNews)

Dave Muoio / MobiHealthNews:

Boston-based OM1, a healthcare industry startup which organizes and analyzes large datasets to measure and predict clinical outcomes, raises $50M Series C — Scale Venture Partners headed the round, which comes roughly a year and a half after OM1's $21 million Series B.

Spotify is prototyping Tastebuds, a social feature that allows users to interact with and discover music by searching the people they follow (Josh Constine/TechCrunch)

Josh Constine / TechCrunch:

Spotify is prototyping Tastebuds, a social feature that allows users to interact with and discover music by searching the people they follow — Spotify is prototyping a new way to see what friends have been listening to, called “Tastebuds.” Despite how discovering music is inherently social …

Finland-based Smartly.io, which helps advertisers automate campaigns across social media platforms, sells a majority stake to Providence Equity for €200M (Anthony Ha/TechCrunch)

Anthony Ha / TechCrunch:

Finland-based Smartly.io, which helps advertisers automate campaigns across social media platforms, sells a majority stake to Providence Equity for €200M — Smartly.io, a company helping advertisers automate their campaigns across Facebook, Instagram and Pinterest …

Job aspirants get duped as fake offer letters on the rise

Warcraft III: Reforged will release on January 28, not in 2019

This week, game developer and publisher Blizzard Entertainment emailed customers who had pre-ordered its upcoming 4K remaster of strategy classic Warcraft III announcing that the game will become playable at 3am PST on January 28, 2020.

The game was previously slated for launch before the end of 2019, but players had begun to suspect some kind of delay when Blizzard didn't provide a firm release date for the game at its otherwise packed BlizzCon conference in early November. The company explained the short delay in a blog post, writing:

Though we've been working hard to get Reforged in your hands before the end of the year, as we started approaching the finish line, we felt we'd need a little extra development time for finishing touches. As always, our goal is to honor the high standards you hold us to.

As recent controversies over crunch in game development have made clear, making triple-A video games is complex and fraught with unexpected roadblocks and ever-shifting scope. Delays like this are common. Some excited players may be frustrated that they have to wait a little longer, but others will be happy to see a focus on quality or saner worker conditions for developers, whichever (if either) the case may be here.

EU finance ministers agreed to set a €3 customs duty on low-value parcels from July 2026, aiming to crack down on cheap Chinese imports from brands like Shein (Reuters)

Reuters : EU finance ministers agreed to set a €3 customs duty on low-value parcels from July 2026, aiming to crack down on cheap Chinese...

-

Amrith Ramkumar / Wall Street Journal : An interview with White House OSTP Director Michael Kratsios, a Peter Thiel protégé confirmed by ...

-

The first project we remember working on together was drawing scenes from the picture books that our mom brought with her when she immigrate...