Stan Schroeder / Mashable:

Xiaomi's first high end smartwatch looks a lot like the Apple Watch, with a button and twisting control knob on the right side — Xiaomi's November 5 event is shaping up to be a pretty big one. — On Monday we wrote about the company's upcoming 108-megapixel phone, but now the company …

Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Tuesday, October 29, 2019

Xiaomi's first high end smartwatch looks a lot like the Apple Watch, with a button and twisting control knob on the right side (Stan Schroeder/Mashable)

After CA passed AB5, a driver group launches a ballot measure to keep gig workers classified as contractors; Uber, Lyft, and DoorDash pledged $90M to defeat AB5 (Megan Rose Dickey/TechCrunch)

Megan Rose Dickey / TechCrunch:

After CA passed AB5, a driver group launches a ballot measure to keep gig workers classified as contractors; Uber, Lyft, and DoorDash pledged $90M to defeat AB5 — A group of Lyft, Uber and DoorDash drivers are announcing a statewide ballot measure for the November 2020 ballot this morning in Sacramento.

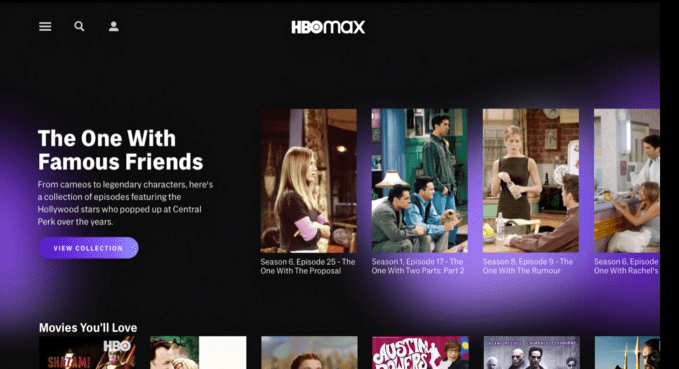

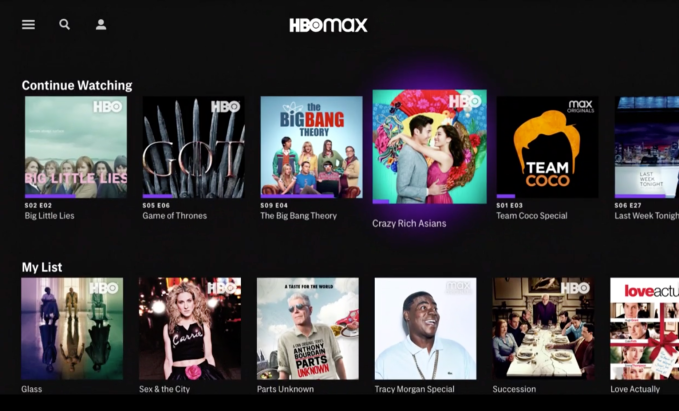

HBO Max to launch in May and cost $15 a month, same as the existing HBO; AT&T plans to bundle free subscriptions for some customers of its other services (Peter Kafka/Vox)

Peter Kafka / Vox:

HBO Max to launch in May and cost $15 a month, same as the existing HBO; AT&T plans to bundle free subscriptions for some customers of its other services — HBO Max will have plenty of competitors, including Netflix and Apple and Disney's new streaming services.

FreshMenu says on path to make profit this fiscal

Slack investor Index Ventures backs Slack competitor Quill

Slack created a new solution for workplace communication, one copied by many, even Microsoft. But the product, which is meant to help individuals and businesses collaborate, has been critiqued for sending too many notifications, with some claiming it’s sabotaged workplace productivity.

Quill, a startup led by Ludwig Pettersson, Stripe’s former creative director and design aficionado, claims to offer “meaningful conversations, without disturbing your team.” The company has raised a $2 million seed round led by Sam Altman with participation from General Catalyst, followed by a $12.5 million Series A at a $62.5 million valuation led by Index Ventures partner and former Slack board observer Sarah Cannon, TechCrunch has learned.

Quill and Cannon declined to comment.

The company, based in San Francisco, has created a no-frills messaging product. Still in beta, Quill plans to encourage fewer, more focused conversations with a heavy emphasis on threads, sources tell TechCrunch. The product is less of a firehose than Slack, says former Y Combinator president Altman, where one can get stuck for extended periods of time filtering through direct messages, threads and channels.

“It’s relentlessly focused on increasing the bandwidth and efficiency of communication,” Altman tells TechCrunch. “The product technically works super well–it surfaces the right information in the feed and it’s pretty intelligent about how it brings the right people into conversations.”

Pettersson previously worked with Altman at his current venture, OpenAI, a research-driven business focused on development that steers artificial intelligence in a “friendlier” direction. Pettersson was a member of the company’s technical staff in 2016 and 2017, creating OpenAI’s initial design.

Index Ventures, for its part, appears to be doubling down on the growing workplace communications software category. The firm first invested in Slack, which completed its highly-anticipated direct listing earlier this year, in 2015. Slack went on to raise hundred millions more, reaching a valuation of over $7 billion in 2018.

Since going public, Slack has struggled to find its footing on the public markets, in large part due to the growing threat of Microsoft Teams, the software giant’s Slack-like product that debuted in 2016. Quickly, Microsoft has gobbled up market share, offering convenient product packages including beloved tools used by most businesses. As of July, Teams had 13 million daily active users and the title of Microsoft’s fastest-growing application in its history. Slack reported 12 million daily active users earlier this month.

Startups like Quill pose a threat to Slack, too. It created the playbook for workplace chat software and proved the massive appetite for such tools; companies are bound to iterate on the model for years to come.

Quill is also backed by OpenAI’s chairman and chief technology officer Greg Brockman and Elad Gil, a former Twitter executive and co-founder of Color Genomics.

HBO Max will cost $14.99 per month and launch in May 2020

AT&T and WarnerMedia just announced the pricing of their HBO Max streaming service, along with sharing more details about the timing and content lineup.

The service will cost $14.99 per month — the same price as HBO Now. WarnerMedia also says it will be free for HBO Now subscribers and for viewers who subscribe to HBO via AT&T. And it will launch in May of next year.

At the event, HBO’s Casey Bloys also announced that HBO has greenlit a Game of Thrones spinoff called House of the Dragon, based on George R.R. Martin’s book of Westerosi history, Fire and Blood (perhaps explaining why a previously announced spin-off that was recently canceled).

The company also revealed that HBO Max will be the exclusive streaming home of South Park. Plus, Elizabeth Banks, Issa Rae and Mindy Kaling are all developing new shows for the service — and Arrow and Riverdale producer Greg Berlanti announced that he’s working on the new DC Comics-related titles Green Lantern and Strange Adventures.

Today’s presentation for media and investors began with lots of commentary about all the corporate synergies between AT&T, WarnerMedia (which AT&T acquired last year) and the service’s namesake HBO.

WarnerMedia’s entertainment and direct-to-consumer chairman Bob Greenblatt said HBO Max will have 10,000 hours of content at launch, including the HBO library, films from Warner Bros. and original content “appealing to all the younger demos.” Ten thousand hours sounds like a lot, but Greenblatt acknowledge it’s less than some competitors (presumably Netflix): “We actually think our value proposition improves when we narrow some of the options.”

HBO Max Chief Content Officer Kevin Reilly made a similar point, noting that on average, half of the usage on subscription streaming services comes from the top 100 titles, so “quality over quantity” is important. To illustrate that quality, he pointed to titles like Sesame Street, as well as the Lord of the Rings movies, The Hobbit movies, The Matrix trilogy and The Conjuring films, plus every Superman and Batman movie from the past 40 years.

“We’re all-in with DC and the associated brand-love that DC generates,” Reilly said.

He also noted the service will also stream the 90’s classic Friends, as well as The Big Bang Theory, for which it reportedly paid over $1 billion.

As for originals, Reilly said the company plans to launch 31 Max Originals series (combined with HBO series, that makes for 69 original shows on HBO Max in its first year). Half of them, apparently, will be targeted at a young adult audience, and with most of the episodes released on a weekly basis — Reilly argued that this allows for more cultural impact, “rather than fading quickly after a binge and burn.”

In terms of the product itself, WarnerMedia’s Executive Vice President Andy Forssell argued that “despite a decade of SVOD evolution, it’s still too hard to find something to watch,” and said HBO Max will “blend the smart use of data with real human touch, and present them via novel product experiences.”

He then showed off how the service will include curated highlights sections focusing on things like Friends episodes with high-profile guest stars. Forssell acknowledged that this might not seem revolutionary, but he argued that it offers a “significant deviation from how SVOD services have used screen real estate.”

It will also expand HBO’s Recommended by Humans feature, where celebrities and other real people can recommend their favorite movies and TV shows. And there will be kids’ profiles and shared profiles — so that the watching you do with others won’t interfere with the progress and recommendations from your own solo viewing.

In July, AT&T first announced its plans for HBO Max, but the details around launch and pricing weren’t yet known. Instead, the attention so far has been on HBO Max’s content lineup.

The service aims to capitalize on HBO’s reputation for premium fare to attract consumers — many of whom already pay $15 per month for HBO Now. But it will pad that HBO library with a combination of programming from other WarnerMedia properties like Cinemax, New Line, DC Entertainment, Warner Bros., The CW, CNN, TNT, TBS, TruTV, Turner Classic Movies, Crunchyroll, Adult Swim, Cartoon Network, Rooster Teeth, Looney Tunes, and others.

We now know HBO Max will be home to Game of Thrones and its upcoming spin-offs, plus favorite HBO series like The Sopranos, Sex and the City, Deadwood, Westworld, and others.

It’s also bringing back Gossip Girl, rebooting Grease, making a Dune TV show, and streaming all 21 Studio Ghibli films.

Other HBO Max shows will include a Riverdale spin-off Katy Keene; Search Party; Batwoman; Adventure Time; Stephen King’s The Outsider; Jordan Peele and J.J. Abrams’ horror series Lovecraft Country; Joss Whedon’s The Nevers; Julian Fellowes’ (Downton Abbey) The Gilded Age; David E. Kelley’s The Undoing; Rules of Magic, a prequel to Alice Hoffman’s Practical Magic; The Boondocks; and Gremlins: Secrets of the Mogwai; plus back catalog content like Fresh Prince of Bel-Air, Pretty Little Liars, Doctor Who (2005 and onward), The West Wing, Top Gear, The Office (original version), and others.

Upcoming literary adaptions include Tokyo Vice, The Flight Attendant, Circe, Made for Love, Station Eleven, and Anna K: A Love Story.

More recently, HBO Max has announced a new documentary on Anthony Bourdain, an overall deal with Lisa Ling, a documentary about Amy Schumer, a Melissa McCarthy comedy film, a documentary with Monica Lewinsky, and a new deal with J.J. Abrams’ Bad Robot (the deal allows Bad Robot to make TV under the WarnerMedia umbrella and then sell it to other streaming services).

Abrams was part of today’s event. He said it’s too early to announce any specific programming under the new deal — Bad Robot already works with HBO on titles like Westworld, and Abrams has a new show in the works called Demimonde — but he declared, “There’s no company that values storytelling more than WarnerMedia.”

And for classic movie lovers who mourn the loss of FilmStruck, Warner Bros. CEO Ann Sarnoff, said the service will offer a rich library of films from the Warner Bros. and MGM library, curated titles from Turner Classic Movies, as well as “decades and decades of more great titles from The Criterion Collection.”

AT&T said on Monday it plans to spend about $2 billion on the service over the next two years and aims to sign up some 50 million subscribers by 2025.

The service will arrive at a time when competition in the streaming market is heating up. Netflix, Hulu and Amazon Prime Video’s successes have paved the way for new entrants like Apple TV+, which launches Friday, and Disney+, which arrives mid-November. NBCU is also joining next year with its streaming service Peacock, which will offer The Office and other classic shows, alongside new originals, like a Battlestar Galactica reboot.

These streamers are gaining at the expense of traditional TV, which has impacted other parts of AT&T’s business.

In the third quarter, it lost another 1.2 million satellite and fiber-optic-TV customers as well as 195,000 AT&T TV Now (previously DirecTV Now) subscribers. AT&T’s profit was down 22% year-over-year to $3.7 billion and revenue had fallen 2.5% to $44.6 billion.

Eventually, AT&T’s plan is to merge its AT&T TV Now live TV service into HBO Max and add on a discounted ad-supported tier to HBO Max to make it more affordable.

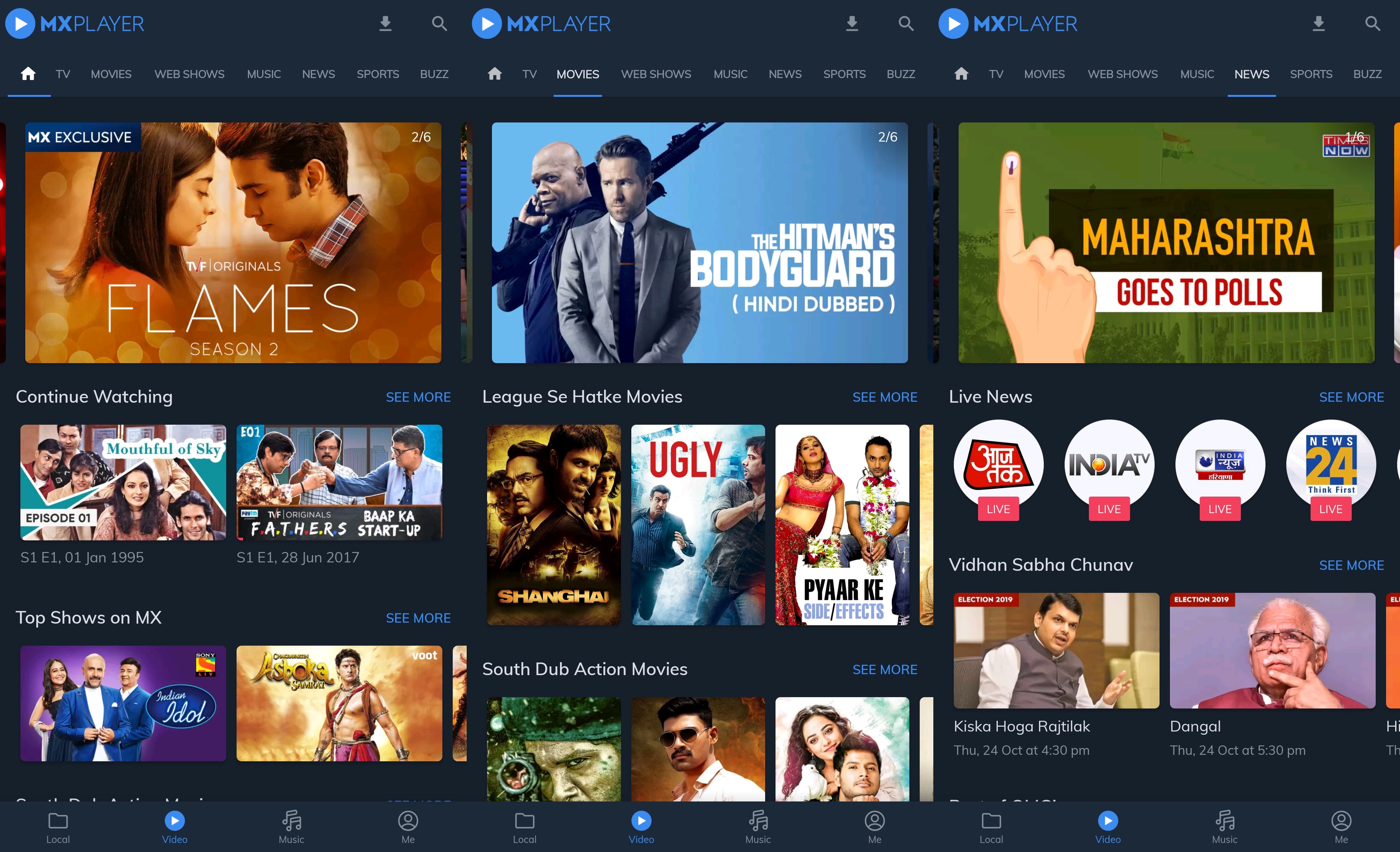

Tencent leads $111M investment in India’s video streaming service MX Player

MX Player, a popular video app that offers both local playback and streaming services, said on Wednesday that it has raised $110.8 million in a new financing round led by Chinese internet giant Tencent as the video app looks to expand its business in India and other international markets.

Times Internet, which acquired a majority stake in MX Player in late 2017 for $140 million, also participated in the Series A financing round. The post-money valuation of MX Player was $500 million, a person familiar with the matter told TechCrunch.

The addition of Tencent — which has invested in a handful of Indian startups including Times Internet-owned Gaana, ride-hailing giant Ola, ed tech startup Byju’s, B2B e-commerce startup Udaan and a bookkeeping service for merchants, Khatabook — “is a great sign of confidence,” said Satyan Gajwani, vice chairman of Times Internet. “Tencent is a leading global force in music and video, and there’s a lot for us to learn and leverage from their capabilities,” he added.

Karan Bedi, CEO of MX Player, said in an interview that the video app will use the fresh capital to double down on producing original TV shows and broadening its catalog of licensed content. The firm, which has so far added 15 original shows to its platform, has already commissioned production of another 20 by year-end, he said.

The Singapore-headquartered firm’s push into original shows and licensed content underscores one of the strangest evolution for a video app. MX Player originated in Korea as an app that could run video files in a wide-range of formats locally stored on a phone.

The app did all of this while consuming little resources, an ability that helped it win tens of millions of users with low-cost Android smartphones in emerging markets such as India. In fact, India is MX Player’s largest market, with 175 million monthly active users, Bedi said. Globally, the app has amassed more than 280 million users.

MX Player is ad-supported and does not charge users any monthly subscription fee. The service, which introduced movies and shows streaming in mid-2018, today also offers access to about 200 TV channels, their current and back catalog of shows, and a music streaming feature through an integration with Gaana.

Bedi said the company has tied up with all-web show producers such as HoiChoi in India and three of the top five TV local cable networks, including Sony and Sun. Missing from the list is Star India, the largest TV network in the country.

Thanks to the acquisition of 21st Century Fox, Disney now owns Star India. Star India has emerged as one of the gems in Disney’s new portfolio. The firm, which runs dozens of TV channels in India, operates Hotstar, the market-leading video streaming service.

Hotstar reported 300 million monthly active users and 100 million daily active users during the ICC Cricket World Cup tournament. The service has cashed in on the popularity of cricket to boost its numbers.

Bedi said MX Player is working on building new entertainment experiences, but sports content is not something it is exploring. The reason is simple: Cricket drives most of the sports streaming in India and Star India has secured rights to most of such content. (Facebook recently grabbed a slice of it, too.)

But cricket alone can’t help a streaming service win and sustain customers. Even Hotstar’s monthly user base plummets below 60 million in the months following the cricketing season, people familiar with Hotstar’s internal figures have told TechCrunch.

Figuring out what exactly resonates with the users in India, the world’s second largest internet market, is the billion-dollar question. The video streaming market in India is on track to be worth $1.7 billion in the next four years, according to PricewaterhouseCoopers.

Bedi, who spearheaded Eros Now’s India business before joining MX Player, said users are increasingly enjoying the original shows. Most of the shows that MX Player has produced so far, such as “Hey Prabhu,” “Thinkistan” and “Immature,” are largely targeted at college students and those who have just joined the work force. But the company is slowly populating the platform with shows such as “Queen” that appeal “universally,” he said.

MX Player today competes with more than three dozen local and international players, nearly all of which offer their services at dirt-cheap prices in India. Even Netflix, which launched in India with a $8 plan in 2016, this year introduced a $2.8 monthly tier. In recent months, several more firms including e-commerce giant Flipkart and food delivery startup Zomato have launched their video streaming services in the country.

Tencent-rival Alibaba announced earlier this year that it would invest $100 million to expand social video app Vmate in India.

Once cautious about each megabyte they spent consuming internet services, Indians are now spending about 10GB of data on their smartphones each month as data prices crash in the country, according to an Ericsson report. Indian billionaire Mukesh Ambani disrupted the local telecom market in 2016 when he launched Reliance Jio. The 4G-only carrier undercut the market by first offering bulk of mobile data at no cost, and then charging very little fee.

An analyst TechCrunch spoke with said it’s only a matter of time before India’s video market begins to see some consolidation and pull back. “You have to offer something appealing that none of your rivals have,” he said, requesting anonymity as he advises many of these businesses.

For MX Player, its odd evolution story may be its biggest advantage. The app’s local video playback feature continues to draw many to it, and keeps the app among the top rated in Google’s Play Store. Bedi said the startup, which today employs about 300 people, maintains a large team that continues to improve the tech stacks to improve video playback support.

Moving forward, MX Player will also look into expanding to some international markets. It recently started beta testing the video streaming service in the U.S., Canada, Australia and New Zealand. Eventually, the startup hopes to make original shows for these markets that are relevant to the local audience there.

MX Player maintains a premium app on Google Play Store that strips ads for $5. But the app continues to mostly rely on revenue it generates from ads. Times Internet’s Gajwani said that at some point in the future, the video service will expand monetization beyond pure advertising. “That said, MX is consumed daily as much as the leading TV channel in India, so there’s significant headroom to capture larger advertising spends as well,” he added.

Paytm, a leading financial services firm in India, was also in talks with MX Player to invest in this financial round. It may invest in the video streaming services app at a later stage, a person familiar with the talks said.

Monday, October 28, 2019

Spotify Says Grew Rapidly in India, Hits 248 Million Active Users Globally

Game of Thrones Creators Quit Star Wars for Netflix Deal

Microsoft Says Russia-Linked Hackers Target Sports Organizations

Google's Search for Sales in Cloud, Hardware Clip Alphabet Profit

Report analyzing 800 Facebook posts about the Assam region in North India finds 26.5% constituted hate speech, and were shared 99K+ times with 5.4M views (Natasha Lomas/TechCrunch)

Natasha Lomas / TechCrunch:

Report analyzing 800 Facebook posts about the Assam region in North India finds 26.5% constituted hate speech, and were shared 99K+ times with 5.4M views — A report by campaign group Avaaz examining how Facebook's platform is being used to spread hate speech in the Assam region …

Moto G8 Plus sale in India today: Price, specs, offers and more

Motorola introduced a new member to the G-series recently. The Moto G8 Plus was launched in Spain on October 24. Now, the smartphone is all set to go on sale in India. The Moto G7 Plus successor sports a new design, better cameras and more. It will go on sale at 12 PM through Flipkart. The Moto G8 Plus' price in India is Rs 13,999 and it will be made available in two colour options, Cosmic Blue and Crystal Pink.

Moto G8 Plus specificationsMoto G8 Plus comes equipped with a 6.3-inch FHD+ IPS LCD display that has a resolution of 2280 x 1080 pixels and 19:9 aspect ratio. It is powered by the Qualcomm Snapdragon 665 chipset, paired with Adreno 610 GPU. The smartphone features 4GB RAM and 64GB of internal storage. Further, it supports up to 512GB of internal storage via microSD card slot. It packs a 4000mAh battery that supports 15W fast charging.

In the optics department, the Moto G8 Plus sports a triple rear camera setup: 48 MP main sensor (f/2.0, Quad Pixel) + 5 MP depth sensor (f/2.2, 1.12um) + 16MP action cam (sensor, f/2.2, Quad Pixel, 2.0um, dedicated ultra-wide camera with FOV 117° video). On the front lies a 25MP selfie shooter ((f/2.0, Quad Pixel). You can check out the camera samples in our first impressions of Moto G8 Plus here.

Moto G8 Plus also supports FM Radio, Bluetooth 5.0, NFC and more. As for sensors, it comes with a fingerprint reader, proximity, accelerometer, ambient light, sensor hub, gyroscope, ultrasonic, and e-compass.

Moto G8 Plus price in India and launch offersAs mentioned earlier, the Moto G8 Plus costs Rs 13,999 for the lone 4GB RAM + 64GB storage variant. As for launch offers, buyers will get a Reliance Jio instant cashback of up to Rs 2,200, Cleartrip coupon worth Rs 3,000 and Zoom Car Vouchers worth Rs 2,000.

Dissent erupts at Facebook over hands-off stance on political ads

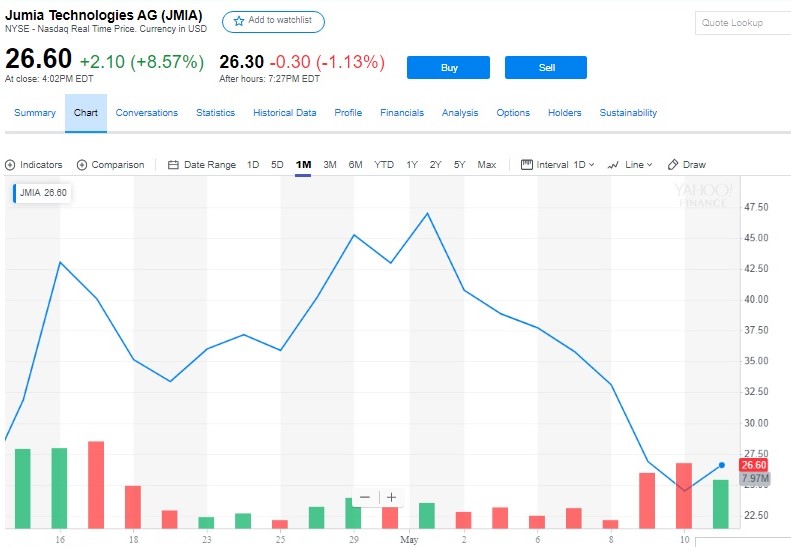

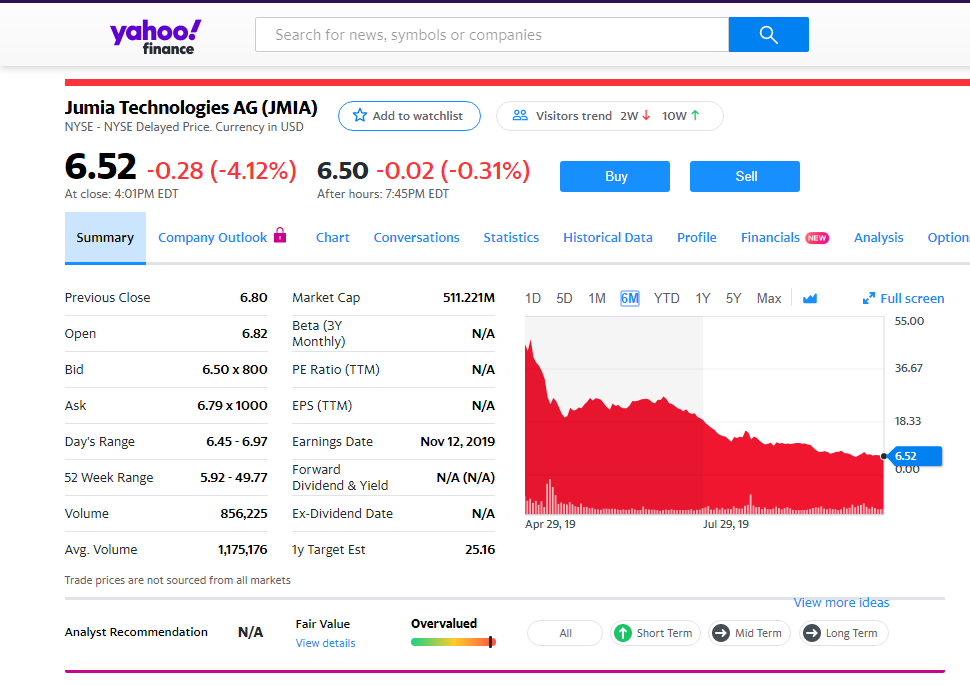

Revisiting Jumia’s JForce scandal and Citron’s short-sell claims

In advance of Jumia’s November financial reporting, it’s worth revisiting the company’s second quarter results, the downside of which included some negative news beyond losses.

The Africa focused e-commerce company — with online verticals in 14 countries — did post second-quarter revenue growth of 58% (≈$43 million) and increased its customer base to 4.8 million from 3.2 million over the same period a year ago.

But Jumia also posted greater losses for the period, €67.8 million, compared to €42.3 million in 2018.

What appears to have struck the market more than revenues or losses was Jumia offering greater detail on the fraud perpetrated by some employees and agents of its JForce sales program.

This was another knock for the firm on its up and down ride since becoming the first tech company operating in Africa to list on the NYSE in April. The online retailer gained investor confidence out of the gate, more than doubling its $14.95 opening share price after the IPO.

That lasted until May, when Jumia’s stock came under attack from short-seller Andrew Left, whose firm Citron Research, issued a report accusing the company of fraud. That prompted several securities related lawsuits against Jumia.

At quick glance, Citron’s primary claim — that Jumia’s SEC filing contained discrepancies in sales figures — shares some resemblance to Jumia’s own disclosures.

The company’s share-price has suffered due to both — falling to less than 50% of its opening in April.

This has all funneled into an ongoing debate across Africa’s tech ecosystem on Jumia’s legitimacy as an African startup, given its (primarily) European senior management. Some of the most critical voices have gone so far as to support Left’s claims on Jumia’s fraud — and accept Jumia’s August admission as validation.

Sound messy and confusing? We’ll, yes, it is. But so go some IPOs.

Jumia’s info vs. Citron’s claims

Evaluating Jumia’s J-Force scandal vs. Citron’s short-sell claims is really Chartered Financial Analyst stuff. Citibank Research issued a brief rebutting Left’s claims in May and then another in August — though the firm has not made either public.

Judging by Jumia’s share-price fluctuation and chatter that continues in Africa’s tech ecosystem, there’s still confusion around both matters.

A simple exercise is to lay out the core of what Jumia has released vs. the crux of Citron Research’s claims.

On the J-Force/improper sales matter, here are excerpts of Jumia’s statement. Note that GMV is Gross Merchandise Value — the total amount of goods sold over the period:

As disclosed in our prospectus dated April 11, 2019, we received information alleging that some of our independent sales consultants, members of our JForce program in Nigeria, may have engaged in improper sales practices. In response, we launched a review of sales practices covering all our countries of operation and data from January 1, 2017 to June 30, 2019.

Jumia did disclose this in its IPO prospectus on page 34.

In the course of this review, we identified several JForce agents and sellers who collaborated with employees in order to benefit from differences between commissions charged to sellers and higher commissions paid to JForce agents. The transactions in question generated approximately 1% of our GMV in each of 2018 and the first quarter of 2019 and had virtually no impact on our 2018 or 2019 financial statements. We have terminated the employees and JForce agents involved, removed the sellers implicated and implemented measures designed to prevent similar instances in the future. The review of this matter is closed.

And finally, Jumia noted this:

More recently, we have also identified instances where improper orders were placed, including through the JForce program, and subsequently cancelled. Based on our findings to date, we believe that the transactions in question generated approximately 2% of our GMV in 2018, concentrated in the fourth quarter of 2018, approximately 4% in the first quarter of 2019 and approximately 0.1% in the second quarter of 2019. These 0.1% have already been adjusted for in the reported GMV figure for the second quarter of 2019. These transactions had no impact on our financial statements. We have suspended the employees involved pending the outcome of our review and are implementing measures designed to prevent similar instances in the future. We continue our review of this matter.

That’s the gist of Jumia’s disclosure: a small number of employees cooked some sales numbers and commissions, it was negligible to our financials, we flagged the investigation in our IPO prospectus, we took action, we ended it.

The Citron Research report Andrew Left issued to support his short-sell position made several critical claims regarding Jumia, but labeled “the smoking gun” as alleged material inconsistencies between an October 2018, Jumia investor presentation and Jumia’s April SEC Form F-1.

For the year 2017, there’s a difference of 600,000 active customers and 10,000 merchants in Jumia’s reporting between the fall 2018 investor presentation and the recent 2019 F-1, according to Citron Research. Citron also goes on to press concerns with GMV:

In order to raise more money from investors, Jumia inflated its active consumers and active merchants figures by 20-30% (FRAUD).

The most disturbing disclosure that Jumia removed from its F-1 filing was that 41% of orders were returned, not delivered, or cancelled.

This was previously disclosed in the Company’s October 2018 confidential investor presentation. This number is so alarming that is screams fraudulent activities. Instead, Jumia disclosed that “orders accounting for 14.4% of our GMV were either failed deliveries or returned by our consumers” in 2018.

TechCrunch connected with Jumia’s CEO Sacha Poignonnec and Citron Research’s Andrew Left since the August earnings reporting and disclosures.

On whether Jumia’s revelation of improper sales practices validated the fraud claims in Citron’s Brief, “It’s not the same,” Poignnonec,” told me on a call last month.

“For every one of those allegations,” he said referring to Left’s research, “there is a clear and simple answer for each of them and we have provided those,” said Poignnonec.

Where is Andrew Left on the matter? “I’m no longer short the stock” he told TechCrunch in a mail this week.

“But that does not mean the stock is a buy whatsoever,” he added — sticking to the fundamentals of his May brief.

What to make of it all?

It appears that what Jumia disclosed in its April prospectus (and added more detail to in August) does not provide one-to-one validation of the claims in Citron Research’s May report.

But then again, the entire matter — the data, the similar terminology, the multiple docs and disclosures — is still all a bit confusing.

That was evident in an exchange between Sacha Poignonnec and CNBC contributor John Fortt after Jumia’s 2nd quarter earnings call (see 1:19). Fort pressed Poignonnec on Left’s claims vs. Jumia’s admissions and still came away a bit puzzled.

The market, too, appears to be impacted by the fuzziness around Jumia’s disclosure of improper sales practices and Andrew Left’s claims.

Jumia’s share price plummeted 43% the week Left released his short-sell claims, from $49 to $26.

The company’s stock price has continued to decline since Jumia’s August earnings call (and sales-fraud disclosure) to $6.52 at close Monday.

The company’s stock price has continued to decline since Jumia’s August earnings call (and sales-fraud disclosure) to $6.52 at close Monday.

That’s 50% below the company’s opening in April and 80% below its high before Citron’s Research brief and Andrew Left’s short-sell position.

Jumia’s core investors appeared to show continued confidence in the company this month, when there wasn’t a big selloff after the IPO lockup period expired.

Even so, Jumia’s 3rd quarter earning’s call on November 12 could be a bit make or break for the company with investors given all the volatility the e-commerce venture has faced since listing and its rapid loss in value.

As a public company now, the most direct way for Jumia to revive its share-price (and investor confidence) would be demonstrating it has reduced losses while maintaining or boosting revenues.

Of course, that’s the prescription for just about any recently IPO’d tech venture.

What Jumia may want to evaluate pre-earnings call is the extent to which its own sales-fraud disclosure and Andrew Left’s allegations are still being mashed together and impacting brand-equity in Africa and investor confidence abroad.

From there it could be wise to address both head on and explain — in a way that is as easy as possible for people to understand — how the two are not the same and don’t have a bearing on Jumia’s brand or business model.

The FCC warns that rural areas may lose cell service if Congress does not fill a $3B funding shortfall for US carriers to replace Huawei and ZTE equipment (Eva Dou/Washington Post)

Eva Dou / Washington Post : The FCC warns that rural areas may lose cell service if Congress does not fill a $3B funding shortfall for US...

-

Jake Offenhartz / Gothamist : Since October, the NYPD has deployed a quadruped robot called Spot to a handful of crime scenes and hostage...

-

Andrew Tarantola / Engadget : An adapted excerpt from the book “Your Computer Is on Fire”, on how voice assistants like Siri and Alexa al...