Ingrid Lunden / TechCrunch:

Intel acquires Israel-based Cnvrg.io, which operates a platform for data scientists to build and run ML models; Intel says Cnvrg.io will remain independent — Intel continues to snap up startups to build out its machine learning and AI operations. In the latest move, TechCrunch has learned …

Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Tuesday, November 3, 2020

Intel acquires Israel-based Cnvrg.io, which operates a platform for data scientists to build and run ML models; Intel says Cnvrg.io will remain independent (Ingrid Lunden/TechCrunch)

Sources: China says Ant Group can't proceed with IPOs until it complies with new capital requirements and reapplies for licenses to operate nationwide (Bloomberg)

Bloomberg:

Sources: China says Ant Group can't proceed with IPOs until it complies with new capital requirements and reapplies for licenses to operate nationwide — - Listing of Jack Ma's fintech giant was halted on Tuesday — Ma criticized regulators for stifling innovation last month

Report: US visas granted to students from mainland China have plummeted 99% since April

It’s no secret that the Trump administration has pursued a variety of avenues to keep foreigners out of the U.S., including through a recent overhaul of the H-1B visa program for high-skilled foreign workers that will require employers to pay H-1B workers higher wages and narrow the types of degrees that would qualify an applicant — a move which has ready triggered numerous lawsuits.

Still, it may surprise some to learn that U.S. visas issued to students around the world have fallen as dramatically as they have this year. According to a new report in Nikkei Asia, citing U.S. State Department data, just 808 F-1 student visas were granted to applicants in mainland China between April and September’s end, which is 99% fewer than the 90,410 F-1 student visas granted during the same period last year. The story is much the same for students of other countries: with 88% fewer F-1 visas granted to students in India, 87% fewer for students in Japan, 75% fewer for students in South Korea and 60% fewer for students from Mexico.

What’s going on? A confluence of factors, seemingly.

Coronavirus is most certainly among them, as families grow more hesitant to send their children to the U.S., which reported 93,581 new cases on Sunday alone, compared with 24 in China, 38,000 in India, 468 in Japan, 97 in South Korea and 3,762 in Mexico.

So is racism, with many Asians and Asian-Americans noting that Donald Trump’s rhetoric around the coronavirus has sharpened the racism they’ve faced throughout their lives, with terms like “kung flu” and “China virus” common in responses, per a recent survey by Washington State University researchers who say that increasing reports of racial discrimination since the start of the COVID-19 pandemic coincide with an increase in reported negative health symptoms. (The Nikkei notes that students already studying in the U.S. have been targets, too, citing a 23-year-old Chinese woman who was yelled at to leave the U.S.)

Yet an aggressive focus on Chinese espionage in Washington has played a bigger role, suggests the outlet, which speculates that the difficulty in obtaining American visas is likely to drive some Chinese students to other countries, including Canada.

Secretary of State Mike Pompeo, for example, said in remarks at the Richard Nixon Presidential Library in July that, “We opened our arms to Chinese citizens, only to see the Chinese Communist Party exploit our free and open society. China sent propagandists into our press conferences, our research centers, our high schools, our colleges and even into our PTA meetings.”

A backlash against Chinese students in particular is not a new one for the Trump administration, even while it’s been accelerated greatly in recent months. In 2018, the State Department began restricting to one year visas for Chinese graduate students studying in certain research fields, after which they need to reapply. The move rolled back a policy established during the Obama administration that allowed Chinese citizens to secure five-year student visas.

Insight Partners, Precursor Ventures join Hustle Fund in raising new fund money

Even as the country is in the final days of a polarizing election, the cogs of VC never stop turning. On this ever-so-quiet, non-election-news Tuesday, venture firms still managed to file paperwork with the SEC indicating newly raised funds. Precursor Ventures and Insight Partners will join Hustle Fund in closing new capital.

The filings are noteworthy because they signal new capital coming into the startup world, which could look dramatically different in the coming weeks. Still, Precursor Ventures and Hustle Fund are both still fundraising, so expect them to (hopefully) add more capital in the coming months.

Precursor Ventures, led by Charles Hudson, has raised a new tranche of capital to invest in pre-seed companies. The firm first filed in March 2020 that it had plans to raise a $40 million fund, and today it appears that it has closed $29 million of that goal. Recent investments from Precursor include The Juggernaut, mmhmm and TeamPay. The fund made headlines recently because it promoted Sydney Thomas, its first hire, to principal. Hudson was unable to comment due to fundraising activity.

We also saw a filing from Insight Partners, which closed a $9.5 billion fund in April for startups and growth-stage investments, indicating that it has raised money for its first-ever Opportunity Fund. The SEC filing shows that Insight Partners has raised $413 million for the opportunity fund. Insight did not return a request for comment.

Earlier today, SEC filings also showed that Hustle Fund has raised $30 million for a second fund, surpassing its previous fund of $11.5 million. Interestingly, paperwork for this new fund was first filed in May 2019 with the intention to raise $50 million. Today’s news, thus, is its first close. While the firm is still fundraising, it’s a long gap between filing and first close. The fund was launched in 2018 by ex-500 Startup partners Eric Bahn and Elizabeth Yin to, similar to Precursor, invest in pre-seed startups. Hustle Fund invests $25,000 checks into 50 startups per year.

Yin declined to comment due to ongoing fundraising activity.

While the spree of funds on Election Day was noteworthy, it was somewhat expected. Generally speaking, funds want to get their paperwork cleared and closed before a potentially chaotic event or time of unrest. We saw closes from OpenView, Canaan, True Ventures and more, while firms including First Round and Khosla filed paperwork for new funds. Time will tell if this is a final exhale of news until January 1, or if the VC world will continue pushing droves of capital, holidays be damned.

‘Stay home’ robocalls on Election Day prompt warnings, investigation

A scourge of robocalls urging Americans to “stay safe and stay home” has gotten the attention of the FBI and the New York attorney general over concerns of voter suppression.

The brief message, which doesn’t specifically mention Election Day, has prompted New York Attorney General Letitia James to launch an investigation into the matter. James announced Tuesday that her office is actively investigating allegations that voters are receiving the robocalls.

“Voting is a cornerstone of our democracy,” James said in a statement Tuesday. “Attempts to hinder voters from exercising their right to cast their ballots are disheartening, disturbing and wrong.”

James added that such calls are illegal and will not be tolerated.

The FBI told TechCrunch that the agency is aware of reports of robocalls. The agency wouldn’t say if it is investigating the robocalls; however, a senior official at the Department of Homeland Security told reporters Tuesday that the FBI was investigating calls that seek to discourage people from voting, according to the AP.

“As a reminder, the FBI encourages the American public to verify any election and voting information they may receive through their local election officials,” the FBI said in a statement sent to TechCrunch.

The announcement from James follows subpoenas issued earlier this week by the New York AG office to investigate the source of these robocalls allegedly spreading disinformation. New York voters who receive concerning disinformation, or face issues at the polls, can contact her office’s Election Protection Hotline at 1-800-771-7755.

“Every voter must be able to exercise their fundamental right to vote without being harassed, coerced, or intimidated. Our nation has a legacy of free and fair elections, and this election will be no different,” James added. “Voters should rest assured that voting is safe and secure, and they should exercise their fundamental right to vote in confidence. We, along with state leaders across the nation, are working hard to protecting your right to vote, and anyone who tries to hinder that right will be held accountable to the fullest extent of the law.”

Last month, the U.S. Department of Justice announced that an interagency working group convened by Attorney General William P. Barr released a report to Congress on efforts to stop illegal robocalls. The report described efforts by the DOJ, including two civil actions filed in January 2020 against U.S.-based Voice over Internet Protocol (VoIP) companies, the Federal Trade Commission and the Federal Communications Commission to combat illegal robocalls. Despite those efforts, and even evidence of some declines in robocalls for a time, the presidential election and the COVID-19 pandemic has fueled a spike in calls.

DHS and the FBI are investigating a robocall and text campaign warning US voters to "stay safe and stay home" (Washington Post)

Washington Post:

DHS and the FBI are investigating a robocall and text campaign warning US voters to “stay safe and stay home” — A Department of Homeland Security official said the FBI was investigating the call, which, along with new robotexts that surfaced in Michigan, prompted warnings about misinformation

European Central Bank President Christine Lagarde says the ECB is now seeking public comments on a potential digital euro (Kevin Reynolds/CoinDesk)

Kevin Reynolds / CoinDesk:

European Central Bank President Christine Lagarde says the ECB is now seeking public comments on a potential digital euro — European Central Bank President Christine Lagarde Sunday announced an ECB survey of public opinion regarding the issuance of a digital euro, implying the central bank …

Monday, November 2, 2020

Wonder Woman 1984 to Be Delayed Again: Report

Twitter Board Backs CEO Jack Dorsey Following Ouster Bid by Activist Investor

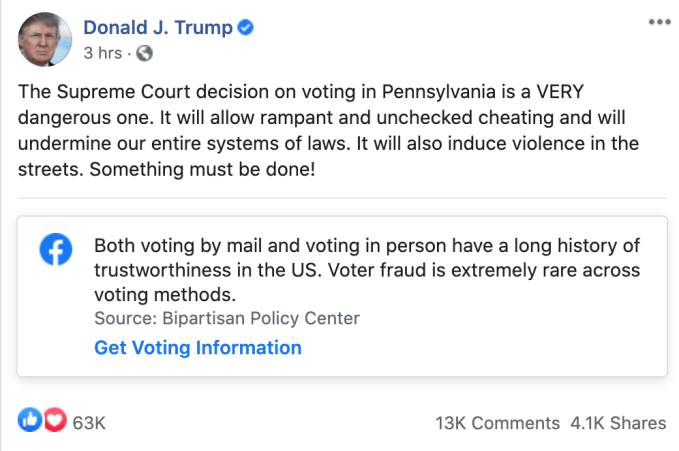

Twitter hides Trump tweet attacking Supreme Court’s decision on Pennsylvania ballots

In an election eve preview of what to expect in the coming days, President Trump pushed the limits on Twitter’s election-specific policies Monday night.

In a tweet, Trump railed against the Supreme Court’s decision to allow Pennsylvania officials to count ballots postmarked by Election Day. The Republican party has waged a brazen legal onslaught against voting rights throughout key states in recent weeks, a cynical effort designed to better the sitting president’s reelection chances.

Twitter pushed back on the president’s false claim about Pennsylvania mail-in ballots, hiding it behind a misinformation warning that calls the tweet “disputed.” Twitter also disabled non-quote retweets, likes and replies for the hidden tweet, which remains viewable but restricted.

Image Credits: Twitter

The Supreme Court decision on voting in Pennsylvania is a VERY dangerous one. It will allow rampant and unchecked cheating and will undermine our entire systems of laws. It will also induce violence in the streets. Something must be done!

— Donald J. Trump (@realDonaldTrump) November 3, 2020

“The Supreme Court decision on voting in Pennsylvania is a VERY dangerous one,” Trump tweeted. “It will allow rampant and unchecked cheating and will undermine our entire systems of laws. It will also induce violence in the streets. Something must be done!”

Facebook did not remove the reposted message, but did add a label emphasizing the trustworthiness of voting systems. Three hours after it was published, Trump’s Facebook post had collected 63,000 likes and 13,000 comments.

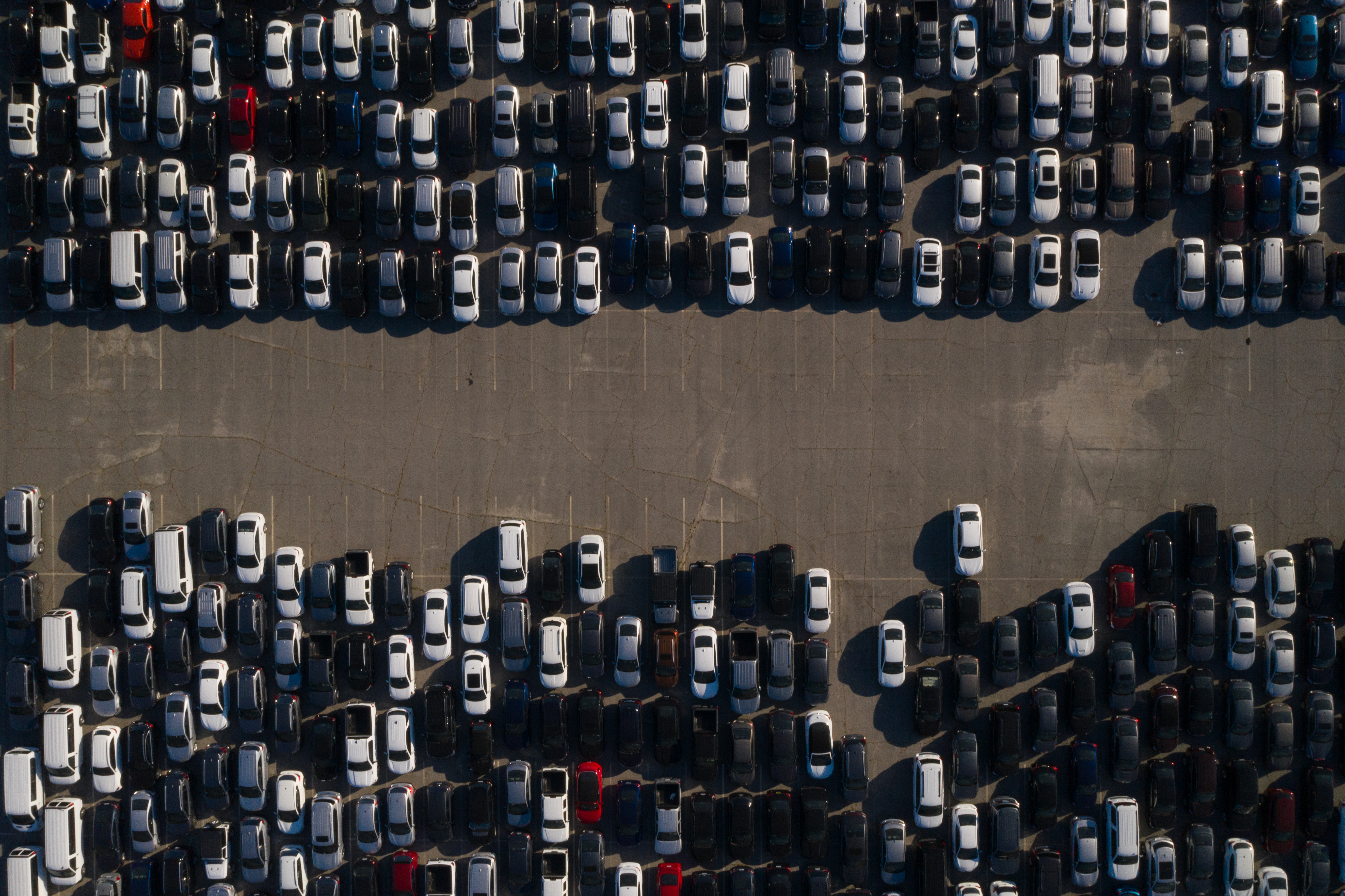

REEF Technology raises $700M from SoftBank and others to remake parking lots

It seems like SoftBank and the Mubadala Corp. aren’t finished taking big swings at the commercial real estate business in the U.S. Even after the collapse of WeWork, the investors are doubling down on a similar business model as part of a syndicate investing $700 million into REEF Technology.

REEF began its life as Miami-based ParkJockey, providing hardware, software and management services for parking lots. It has since expanded its vision while remaining true to its basic business model. While it still manages parking lots, it now it adds infrastructure for cloud kitchens, healthcare clinics, logistics and last-mile delivery, and even old school brick and mortar retail and experiential consumer spaces on top of those now-empty parking structures and spaces.

Like WeWork, REEF leases most of the real estate it operates and upgrades it before leasing it to other occupants (or using the spaces itself). Unlike WeWork, the business actually has a fair shot at working out — especially given business trends that have accelerated in response to the health and safety measures implemented to stop the spread of the COVID-19 pandemic.

In part that’s because REEF does operate its own businesses on the premises and works with startups to provide actual goods and services that are location dependent for their success and revenue generating.

The money will be used to scale from its roughly 4,800 locations to 10,000 new locations around the country and to transform the parking lots into “neighborhood hubs,” according to Ari Ojalvo, the company’s co-founder and chief executive.

SoftBank and Mubadala are joining private equity and financial investment giants Oaktree, UBS Asset Management and the European venture capital firm Target Global in providing the cash for the massive equity financing. Meanwhile, REEF Technology and Oaktree are collaborating on a $300 million real estate investment vehicle, the Neighborhood Property Group, as Bloomberg reported on Monday.

In all, REEF, which could reasonably be described as a WeWork for the neighborhood store, has $1 billion in capital coming to build out what it calls a proximity-as-a-service platform.

Since taking a minority investment from SoftBank back in 2018 (an investment which reportedly valued the company at $1 billion) and transforming from ParkJockey into REEF Technology, the company added a booming cloud kitchen business to support the increase in virtual restaurant chains.

In addition, it added a number of service providers as partners, including last-mile delivery startup Bond (and the logistics giant, DHL); the national primary healthcare services clinic operator and technology developer, Carbon Health; the electric vehicle charging and maintenance provider, Get Charged; and — at its operations in London — the new vertical farm developer, Crate to Plate (Ojalvo said it was in talks with the established vertical farming companies in the U.S. on potential partnerships).

Next year, the company plans to launch the first of its experiential, open-air entertainment venues at a space it operates in Austin, according to Ojalvo.

And further down the road, the company sees an opportunity to serve as a hub for the kinds of data-processing centers and telecommunications gateways that will power the smart city of the 21st century, Ojalvo said.

“We have inbound interest from companies that do edge computing and companies getting ready with 5G,” he said. “Data and infrastructure is a big part of our neighborhood hub. It’s like electricity. Without electricity and connectivity, we don’t have the world we want to see.”

Rental cars are stored in a parking lot at Dodger Stadium in this aerial photograph taken over Los Angeles, California, U.S., on Wednesday, May 27, 2020. Hertz Global Holdings Inc. will sell as many of its rental cars as possible while in bankruptcy to bring its huge fleet in line with reduced future demand in a post-pandemic economy.

The bulk of the company’s revenue is coming from its parking business, but Ojalvo expects that to change as the its cloud kitchen business continues to grow. “Neighborhood Kitchens will be a significant part of non-parking revenue,” said Ojalvo.

REEF already operates more than 100 Neighborhood Kitchens across more than 20 markets in North America, and that number will only grow as the company expands its regional footprint. It’s hosting virtual kitchens from celebrity chefs like David Chang’s Fuku, and, according to the company, offering lifelines to beloved local restaurateurs like the chain Jack’s Wife Freda in New York or Michelle Bernstein’s kitchens in Miami.

These restaurants are, in some cases, taking advantage of the employees that REEF Technology has operating its network of kitchens. It’s another difference between WeWork and REEF. The company not only provides the space, in many instances it’s providing the labor that’s allowing businesses to scale.

The company already employs over a thousand kitchen workers prepping food at its restaurants. And REEF acquired a company earlier in May to consolidate its back-end service for on-demand deliveries.

That same strategy will likely apply to other aspects of the company’s services, as well.

“We’re building a platform of proximity,” says Ojalvo. “That proximity is driven through an install base that’s in parking lots or parking garages… [and] that enables all sorts of companies to use its proximity as a platform. To basically build their marketplaces.”

CARDIFF, UNITED KINGDOM – DECEMBER 22: A Deliveroo rider at work at night on December 22, 2018 in Cardiff, United Kingdom. (Photo by Matthew Horwood/Getty Images)

As REEF raises money for expansion, it’s tapping into a new theory of urban development embraced by mayors from Amsterdam to Tempe, Ariz. calling for a 15-minute city (one where the amenities needed for a comfortable urban existence are no more than 15 minutes away).

It’s a worthwhile goal, but while mayors seem to place the emphasis on the availability of accessible amenities, REEF’s leadership acknowledges that only a few of its parking lots and garages will be multi-use and accessible to neighborhood residents. According to a spokesman, only several hundred of the company’s planned 10,000 businesses will have the kind of multi-use mall environment that encourages neighborhood access. Instead, its business seems to be based on the notion that most delivery services should be no more than 15 minutes away.

It’s a different project, but it also has a number of supporters. One could argue that cloud kitchen providers like Zuul, Kitchen United, and Travis Kalanick’s Cloud Kitchens all ascribe to the same belief. Kalanick, the Uber co-founder and former CEO whose company received billions from SoftBank, has been snapping up properties in the US and Asia under an investment vehicle called City Storage Systems, which also uses parking lots and abandoned malls as fulfillment centers.

Big retailers also have taken notice of the new revenue stream and one of America’s largest, Kroger, is even running a ghost kitchen experiment in the Midwest.

If that’s not enough, there are plenty of under-utilized assets that are already on the market thanks to the economic downturn wrought by the COVID-19 pandemic and the government’s efforts to contain it.

“I guess a lot depends on how you think delivery players work out in the coming years versus say drive through or curbside pickup which seems to be where large national players are focused (Starbucks, McDonalds, Dominos, etc),” wrote on venture investor in an email. “But how do delivery players use these spaces versus say lots of low cost retail spaces that can be used to staging or package returns. Maybe there is a play to add modular or prefab units to the existing parking spaces on provide flex for scaling, but it’s not clear that anyone is growing at a frantic pace… I’m just not sure how to see converted parking versus other… commercial spaces for retail or office that are all searching for new applications.”

REEF Technology last mile delivery vehicle and DHL-branded vehicle. Image Credit: REEF Technology

The COVID-19 outbreak that has changed so much of modern life in America so quickly in the span of a single year didn’t create the urge to transform the urban environment, but it did much to accelerate it.

As REEF acknowledges, cities are the future.

Roughly two-thirds of the world’s population will live in cities by 2050, and the world’s largest cities are cracking under the pressures of economic, civil, and environmental transformations that they have not been able to address effectively.

Mobility and, by extension, places to store and maintain those mobile technologies are part of the problem. Roughly half of the average modern American city, as REEF notes, is devoted to parking, while parks occupy only 10% of urban spaces. REEF’s language is centered on changing a world of parking lots into a space of paradises, but that language belies a reality that makes its money (at least for now) off of isolating individuals into personal spaces where their commercial needs are met by delivery — not by community interaction.

Still, the fact remains that something needs to change.

“Traditional developers and local policies have been slow to adopt new technologies and operating models,” said Stonly Baptiste, an investor in the transformation of urban environments through the fund, Urban.Us (which is not a backer of REEF). “But the demand is growing for a better ‘city product’, the need to make cities better for the environment and our lives has never been greater, and the dream to build the city of the future never dies. Not that dream is subsidized by VC.”

Twitter board expresses confidence in CEO Jack Dorsey

Setback for Nokia in German patent battle with Lenovo

Finland, Canada, the US, and other countries are testing tech for passport-free travel, including facial recognition and a "digital travel credential" (Matt Burgess/Wired)

Matt Burgess / Wired : Finland, Canada, the US, and other countries are testing tech for passport-free travel, including facial recogniti...

-

Jake Offenhartz / Gothamist : Since October, the NYPD has deployed a quadruped robot called Spot to a handful of crime scenes and hostage...

-

Answers to common questions about PCMag.com http://bit.ly/2SyrjWu https://ift.tt/eA8V8J