Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Sunday, October 4, 2020

Xiaomi Redmi 9 with 4GB RAM to go on sale today via Amazon

SMIC Has Had 'Preliminary Exchanges' With US Over Export Restrictions

5G's Arrival Tees Up Patent Fights in Market Set to Grow 12,000 Percent

After pushback from Indian developers, Google says it will delay the enforcement of its 30% cut on IAPs from Play Store in India from Sept. 2021 to April 2022 (Surabhi Agarwal/The Economic Times)

Surabhi Agarwal / The Economic Times:

After pushback from Indian developers, Google says it will delay the enforcement of its 30% cut on IAPs from Play Store in India from Sept. 2021 to April 2022 — Bengaluru: Google deferred the enforcement of 30% commission on in-app purchases of digital goods from its Play Store in India …

Google delays mandating Play Store’s 30% cut in India to April 2022

Google is postponing the enforcement of its new Play Store billing policy in India to April 2022, days after more than 150 startups in the world’s second largest internet market forged an informal coalition to express concerns over the 30% charge the Android-maker plans to mandate on its store and started to explore an alternative marketplace for their apps.

The company, which is going live globally with the new Play Store rule in September 2021, is deferring the enforcement of the policy only in India, it said. It is also listening to developers and willing to engage to allay their concerns, it said.

Last week, Google said it would no longer allow any apps to circumvent its payment system within the Play Store. The move, pitched by Google as a “clarification” of its existing policy, would allow the company to ensure it gets as high as a 30% cut on in-app purchases made through Android apps operating in a range of a categories.

Google’s announcement today is a direct response to the loudest scrutiny it has received in a decade in India — its biggest market by users but also a place where, compared to Western markets, it generates little revenue. More than 150 startups in India last week formed an informal coalition to fight the company’s strong hold on Indian app ecosystem. Google commands 99% of the smartphone market in India, according to research firm Counterpoint.

Among the startups that have expressed concerns over Google’s new policy are Paytm, India’s most valuable startup, payments processor Razorpay, fantasy sports firm Dream11, social network ShareChat, and business e-commerce IndiaMART.

More than 50 Indian executives relayed these concerns to India’s Ministry of Electronics and Information Technology over a video call on Saturday, according to three people who attended the call.

Several businesses in India have long expressed concerns with the way Google has enforced its policies in India, but the matter escalated last month after the company temporarily pulled Paytm app from the Play Store for promoting gambling.

Google said Paytm had repeatedly violated its policies, and the company’s Play Store has long prohibited apps that promote gambling in India. Google has sent notices about warnings over gambling to several more firms in India in recent weeks.

A senior industry executive told TechCrunch that the company should have expressed these concerns months before the popular cricket tournament IPL was scheduled to commence. Fantasy sports apps allow users to pick their favorite players and teams. These players stand to win real money or points that they can redeem for physical goods purchase based on the real-world performance of their preferred teams and players. IPL season sees a huge surge in popularity of such fantasy sports apps.

“The IPL even got delayed by months. Why did Google wait for so long? And why does the company have a problem with so-called gambling in India, when it permits such activities in other markets? The Indian government has no problem with it,” the executive said, requesting anonymity.

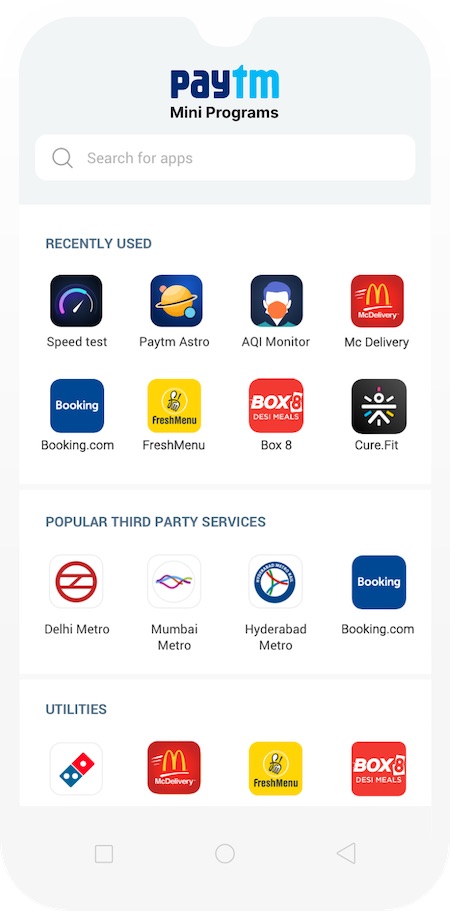

Paytm on Monday announced its own mini-app store featuring several popular services including ride-hailing firm Ola, health care provides 1mg and Practo, fitness startup Cure.fit, music-streaming service Gaana, car-rental provider Zoomcar, Booking.com, and eateries Faasos, Domino’s Pizza, and McDonald’s. The startup claimed that more than 300 firms have signed up for its mini store and that its app reaches more than 150 million users each month. (In a written statement to TechCrunch, Paytm said in June its app reached more than 50 million users in India each month.

Paytm, which says its mini-app store is open to any developer, will provide a range of features including the ability to support subscriptions and one-step login. The startup, which claims said it will not charge any commission to developers for using its payments system or UPI payments infrastructure, but will levy a 2% charge on “other instruments such as credit cards.”

“There are many challenges with traditional mobile apps such as maintaining multiple codebases across platforms (iOS, Android or Web), costly user acquisition and requirement of app release and then a waiting period for user adoption for any change made in the app. Launching as a Mini Apps gives you freedom from all these hassles: implying lesser development/testing and maintenance costs which help you reach millions of Paytm users in a Jiffy,” the Indian firm said in its pitch.

The launch of a mini-store further cements Alibaba-backed Paytm’s push into turning itself into a super-app. Its chief rivals, Walmart-backed PhonePe and Google Pay, also operate similar mini stores on their apps.

Whether Paytm’s own mini app store and postponement of Google’s new Play Store policy are enough to calm other startups’ complaints remain to be seen. PhonePe is not one of the mini apps on Paytm’s store, a Paytm spokesperson told TechCrunch.

“I am proud that we are today launching something that creates an opportunity for every Indian app developer. Paytm mini app store empowers our young Indian developers to leverage our reach and payments to build new innovative services,” said Vijay Shekhar Sharma, co-founder and chief executive of Paytm, in a statement.

As Twitter announced sweeping action against tweets wishing for Trump's death, many users noted years of light enforcement of its "abusive behavior" policy (Jody Serrano/Gizmodo)

Jody Serrano / Gizmodo:

As Twitter announced sweeping action against tweets wishing for Trump's death, many users noted years of light enforcement of its “abusive behavior” policy — Wishing someone else ill will or death is a disgusting act that makes the world worse.

Japanese electronics company NEC says it has agreed to buy Swiss banking software developer Avaloq for $2.2B (Jada Nagumo/Nikkei Asian Review)

Jada Nagumo / Nikkei Asian Review:

Japanese electronics company NEC says it has agreed to buy Swiss banking software developer Avaloq for $2.2B — Japanese electronics company will use acquisition to drive growth in sector — TOKYO — Japanese electronics giant NEC will purchase Swiss banking software developer Avaloq …

Ola loses its operating licence in London over public safety failings

Poco X3 to Go on Sale Today at 12 Noon via Flipkart

Realme Narzo 20, Realme 7 Pro to Go on Sale in India Today

Paytm's mini-app store is live

Flipkart decks up with tech for festival shoppers

Digging into the next wave of tech IPOs

After taking five consecutive business days off from my work laptop — and to shout at my personal laptop while losing games on Dominion online — I am back. I missed you. And while The Exchange’s regular columns were off this week (Friday aside, which you can read here), there’s still a hell of a lot to talk about.

First, a new website. If you click here, you’ll be taken to a sortable list (spreadsheet? database?) of startups with Black founders. Dubbed The Black Founder List, it’s a great asset and tool.

For folks like myself with a research and reporting focus, the list’s sortability of companies founded by Black entrepreneurs by gender, stage and market focus is amazing. And, for investors, it should provide potential dealflow. Do you write lots of Series C checks? The Black Founder List has 23 Series B startups with Black founders. Or if you prefer Series D checks, there are 11 Series C startups with Black founders to check out.

Who is writing the most checks to Black founders? Among the top names are M25, a midwest VC group, Techstars Boston and a number of angels.

The website was compiled by much the same team that TechCrunch highlighted earlier this year, when their data collection work concerning Black founders was more spreadsheet than app. So, please point your thanks for the new resource to Yonas Beshawred, Sefanit Tades, James Norman and Hans Yadav.

The Black Founder List also has a data submission button, so if you notice a missing name, add it. I want the data set to be as robust as possible, as, I reckon, it will prove a great reporting resource. And public data like this obviates certain excuses from the investing class.

Market Notes

- I missed a lot this week that I was looking forward to, including the Asana and Palantir IPOs. For fuller thoughts, head here. Summaries follow:

- Asana’s direct listing and resulting valuation and implied revenue multiples make its direct listing a win for the company, and the model. If other SaaS companies have the ability to raise ample pre-debut cash, perhaps the direct listing is not as dead as it seemed a few months ago when SPACs stole its spotlight, and most companies were pursuing traditional IPOs regardless.

- Palantir’s direct listing did not feel hot until it dropped some strong revenue guidance. With that, its direct listing went fine despite its cosmically comedic voting structure. Watching Palantir’s higher-ups try to snuff public input while still providing a thin patina of democracy made me think more about Russia or Texas than a functioning democratic system.

- Looking ahead, Airbnb is said to be hunting up $3 billion for its own IPO. Airbnb had to take on a lot of expensive cash when its business collapsed in the early COVID days. It wanted to direct list. Now it’s going to cash in a huge pile during its debut.

- Good. More capital > less capital.

- Sticking to our late-stage theme, when I left, Root was said to be pursuing an IPO, and when I came back, Roblox is now also tipped to be plotting with the public markets. (Root’s IPO in the wake of the successful Lemonade debut made sense. Insurtech is hot.)

- The news should not be a surprise; Roblox’s model has found cachet with young gamers and has found a great way to make money at the same time. With a mix of Legos and video game design and Minecraft, perhaps it’s not a surprise that the company is doing well.

- Reuters reports that Roblox could be worth $4 billion when it goes public. I believe it.

- Datto is going public. Ron and Danny have the details here.

- And I chatted with a few Accel investors, the juicy bits from which you can find here.

Various and Sundry

- Draper Esprit, a Europe-focused venture capital fund that trades on the London Stock Exchange, raised £110 million this week. Esprit is a fun shop to track (I’ve known its denizen James since his LSE days), because it’s more transparent than most VC firms than you’re familiar with thanks to its structure.

- According to the firm’s release, its share sale was “oversubscribed.” Tech.eu has more.

- Mobile app spend grew to $29.3 billion in Q3, driven by 36.5 billion installs, per SensorTower. Revenue was up 32% year-over-year.

- Uber sold $500 million worth of Uber Freight to a PE firm.

- As noted, tech stocks had a bad September, but just how bad might surprise you.

- And I covered Noyo’s Series A before I left, with the post going up on Monday.

- In short, Noyo is doing the hard work to build APIs to connect the world of health insurance. It’s a huge, hard task.

- The $12.5 million was “led by Costanoa Ventures and Spark Capital. Prior investors Core Innovation Capital, Garuda Ventures, the Webb Investment Network, Precursor Ventures and Homebrew upped their investment in the new round.”

- (I can’t shake the thought that there’s something in the middle of the no-code/low-code boom, and startups delivering more of their products via APIs instead of as managed services. And please don’t say mashups, we left that phrase behind ages ago.)

- I missed the window for officially commenting on the Coinbase culture dustup — the Equity crew did talk about it while I was AFK — so I will merely share this thread as my $0.02.

- Also, read this from Eileen Burbidge on TechCrunch concerning the same matter. It’s good.

Regular morning Exchange columns return Monday morning. It’s good to be back.

By the way, TechCrunch Sessions: Mobility is coming up next week. I am going! To help you get there, here’s a 50% off code for you to get full access to the event. Or if it’s your jam, this code will get you into the expo and breakout sessions for free.

Chat soon,

Meet Cocoa Press, the Philly startup making a 3D printer for chocolate

Evan Weinstein, the founder of the Philadelphia-based startup, Cocoa Press, which makes a 3D printer for chocolate, doesn’t have much of a sweet tooth. But the young founder was fascinated by 3D printing technologies and was looking for a way to move the technology forward. “I stumbled on chocolate,” Weinstein said. And the result, was Cocoa Press.

The chocolate printer takes advantage of the fact that there’s something about food that people connect to, Weinstein has said, and that’s especially true of chocolate.

Worldwide, chocolate was a $130.5 billion industry in 2019, according to a report by GrandView Research, and Weinstein thinks that his printers can help amateur hobbyists and chocolate enthusiasts bite into that market.

The University of Pennsylvania graduate started developing the technology that would become his first business as a high school student at Springside Chestnut Hill Academy, a private school in Northwest Philadelphia.

After documenting his progress on his personal blog, Weinstein hung up his cocoa nibs at Penn while he pursued his undergraduate degree. But he could never fully rid himself of the chocolate addiction, so he picked the project back up as a senior and returned to the chocolate shop. A 2018 video from Weinstein shows the printer at work.

With a few grants from the University and a bit of funding from its Pennovation Accelerator, Weinstein began building in earnest and the company is now ready to take pre-orders for his $5,500 printer.

As he moves toward commercialization of his confectionary creation, Weinstein is following in some illustrious cocoa-dusted footprints. Five years ago, none other than Pennsylvania’s most famous chocolatier, Hersheys, tried its hand at a chocolate 3D printer. The company took its novel technology on the road and showcased its technical feat at a number of demonstrations, but the project melted under the harsh glare of unfeasible economic realities.

Weinstein has actually talked to the Hersheys folks and believes that his product can be a stickier proposition for consumers and businesses.

“They never ended up creating a sellable printer,” Weinstein said. “I’ve been able to connect with Hershey because they’re the main sponsors of the Pennovation Center… [they said] the limitations at the time were technical limitations, but the customer feedback that they got was really positive.”

That means, as far as Weinstein is aware, his is the only chocolate printing company in the U.S.

Sweet business model

The first chocolate bar was created by the British chocolatier J.S. Fry and Sons in 1847, molded from a paste made of sugar, cocoa butter, and chocolate liquor. But it wasn’t until Daniel Pieter and Henri Nestle brought milk chocolate to the mass market in 1876 and Rudolf Lindt invented the conch machine to mix and aerate chocolate in 1879 that the bars really took off.

Form factors haven’t changed much since then, but Cocoa Press promises to change that, according to Weinstein.

The company sources its chocolate from the biggest white label chocolate providers on the market, The Guittard Chocolate Company and Callebaut Chocolate and will resell chocolate refills to its customers to create a recurring revenue model. Companies can make their own chocolate and use that as well, Weinstein said.

“We don’t want to be competing with the thousands of chocolate shops already out there,” he said. “We just want to get the chocolate printer out into the world. The business model is the machines plus the consumables for people who don’t have a background in chocolate.”

Weinstein envisions the Cocoa Press becoming an all-in-one chocolate shop, where customers can buy the printer and the chocolate from the company and then make their own. There are even plans to work with a couple of bean-to-bar chocolate manufacturers to distribute some of their own single origin chocolates.

Image Credits: Noah Weinstein / Cocoa Press (opens in a new window)

Chocolate shops can spend roughly $57,000 to buy the equipment they need, according to Weinstein, and at $5,500 the Cocoa Press begins to look like a bargain.

Weinstein expects to be shipping the printers by the middle of next year and will be launching pre-orders on October 10.

The young entrepreneur estimates that the market for 3D-printed confections would be half-a-billion dollar industry worldwide, but that doesn’t take into account chocolates, which have been too difficult for developers to manufacture an economical machine to produce.

And while Weinstein may not have started out with a sweet tooth, he’s certainly developed a taste for the industry now. And is looking forward to bringing the chocolates from small producers to a wider audience of connoisseurs who could potentially become entrepreneurs using his machine.

“I’m really excited about working with these small shops because they make some interesting stuff,” Weinstein said. “There’s a cinnamon cumin flavor… it’s just wonderful.”

YouTube launches a Premium paywall for song lyrics on YouTube Music, after testing it in recent months; users get five free lyrics before they have to subscribe (Abner Li/9to5Google)

Abner Li / 9to5Google : YouTube launches a Premium paywall for song lyrics on YouTube Music, after testing it in recent months; users get...

-

Amrith Ramkumar / Wall Street Journal : An interview with White House OSTP Director Michael Kratsios, a Peter Thiel protégé confirmed by ...

-

http://bit.ly/2XqNIDz