Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Thursday, March 5, 2020

Clearview AI's facial recognition app was used by the company's investors, clients, and friends to "test" its tech for over a year prior to public scrutiny (Kashmir Hill/New York Times)

Kashmir Hill / New York Times:

Clearview AI's facial recognition app was used by the company's investors, clients, and friends to “test” its tech for over a year prior to public scrutiny — Investors and clients of the facial recognition start-up freely used the app on dates and at parties — and to spy on the public.

EU reaches a data-sharing agreement with AirBnB, Booking.com, others, to help mitigate the impact on local communities caused by short-term rental market (Patrick Whyte/Skift)

Patrick Whyte / Skift:

EU reaches a data-sharing agreement with AirBnB, Booking.com, others, to help mitigate the impact on local communities caused by short-term rental market — It's hard to know whether greater transparency will benefit or hinder these short-term rental platforms.

Nvidia acquires SwiftStack, a small AI-focused data storage and management platform it currently uses, for an undisclosed sum (Chris Mellor/Blocks and Files)

Chris Mellor / Blocks and Files:

Nvidia acquires SwiftStack, a small AI-focused data storage and management platform it currently uses, for an undisclosed sum — Nvidia is buying SwiftStack, an object storage software company. Terms were undisclosed but the takeover looks like a white knight move by Nvidia.

South Korea passes crypto legal framework legislation, letting the country's regulators oversee and develop rules for cryptocurrencies and crypto exchanges (Danny Crichton/TechCrunch)

Danny Crichton / TechCrunch:

South Korea passes crypto legal framework legislation, letting the country's regulators oversee and develop rules for cryptocurrencies and crypto exchanges — The South Korean National Assembly passed new legislation today that will provide a framework for the regulation and legalization of cryptocurrencies and crypto exchanges.

Spindrift, maker of fizzy drinks, has raised $29.8 million

Spindrift, maker of fizzy soda and sparkling water, has raised $29.8 million in a funding round, per an SEC filing. The Charlestown, Mass. company was founded by Bill Creelman and has raised $70 million in known venture capital funding to date, per Crunchbase data.

The company did not immediately respond to request for comment.

Previous investors in the fizzy drink company include Almanac Insights, KarpReilly, Prolong Ventures, VMG Partners and more. Spindrift, founded in 2010, is up against big players, like the beloved and decades-old LaCroix, another sparkling water brand. Spindrift differentiates itself by emphasizing “real fruit” in its drinks. Think cucumbers from Michigan, strawberries from California and Alfonso mangoes from India. A day prior to the filing, Spindrift launched its pineapple flavor.

(In a quick aside looped up with a word we haven’t heard in a while: The company also offered a Golden Pineapple sweepstakes, where 13 winners will get a year’s-supply of free Spindrift and a custom mini-fridge).

Now, it’s worth mentioning that in San Francisco’s Marina district is another fruit-infused direct to consumer brand, sans the bubbles. Hint, founded in 2005 by Kara Goldin, has raised $26.5 million to date from The Perkins Fund and Verlinvest to produce naturally flavored fruit-essence water.

Today, Spindrift raised more than Hint’s total funding in one fell swoop, and both brands, alongside the age-old LaCroix, are synonymous with startup culture and recycling bins. And that tells us that at least according to investors, the future of water is far from, ahem, drying up.

Axiom Space pitches its first 10-day, all-inclusive trip to the ISS for just $55 million

Axiom Space is looking to make history by sending three passengers on a round-trip journey to the International Space Station for the low, low price of $55 million.

The Houston-based, venture-backed company has signed a contract with SpaceX for a Crew Dragon flight which will transport a commander trained by Axiom along with three private astronauts to and from the International Space Station.

The mission is set to launch in the second half of 2021 and will allow the three-person crew to live on board the ISS for and “experience at least eight days of microgravity and views of the Earth that can only be appreciated in the large, venerable station,” according to a statement from the company.

For company chief executive, Michael Suffredini, the trip is an extension of his previous work as a previous manager of the ISS for the National Aeronautics and Space Administration.

“This history-making flight will represent a watershed moment in the march toward universal and routine access to space,” Suffredini said in a statement. “This will be just the first of many missions to ISS to be completely crewed and managed by Axiom Space – a first for a commercial entity. Procuring the transportation marks significant progress toward that goal, and we’re glad to be working with SpaceX in this effort.”

The trip marks the first of several “precursor missions” to the Space Station under the Space Act Agreement Axiom signed with NASA. Discussions are underway between the agency and the company to establish agreements for other private astronaut missions to the ISS.

Axiom wants to offer passengers two flights per year — aligning with the schedule of opportunities that NASA is making available, while building it works to build its own privately funded space station.

The company has already tapped institutional investors to achieve its goal, with $16 million collected from various individual and institutional investors including Balfour Capital and Starbridge Venture Capital, according to information in Crunchbase.

“Since 2012, SpaceX has been delivering cargo to the International Space Station in partnership with NASA and later this year, we will fly NASA astronauts for the first time,” said SpaceX President and Chief Operating Officer Gwynne Shotwell, in a statement. “Now, thanks to Axiom and their support from NASA, privately crewed missions will have unprecedented access to the space station, furthering the commercialization of space and helping usher in a new era of human exploration.”

Axiom said it will provide all the training, planning, hardware, life support, medical support, crew provisions, safety certifications and on-orbit operations for travelers willing to take the jump into spaceflight.

And the company was selected by NASA to attach its space station modules to the ISS beginning in the second half of 2024. The goal there is to create a private segment of the space station and extend its usable and habitable volume. When the space station is decommissioned, Axiom wants to detach its segment and operate as a free-flying commercial space station.

For SpaceX, the Axiom deal extends the commercial operations of its Crew Dragon craft beyond just NASA astronauts and offers a nice additional revenue stream.

This is actually the second deal between SpaceX and a commercial manned space tourism company. Last month the company inked an agreement with space Advnetures for a trip that would fly four passengers on a five day trip using a Crew Dragon vehicle.

Appeals court declines to invalidate one of the WiFi-related patents underlying a $1.1B verdict Caltech has won against Apple and Broadcom (Juli Clover/MacRumors)

Juli Clover / MacRumors:

Appeals court declines to invalidate one of the WiFi-related patents underlying a $1.1B verdict Caltech has won against Apple and Broadcom — Apple in January was ordered to pay the California Institute of Technology (Caltech) $838 million for infringing on Caltech patents related to WiFi transmissions.

Researchers discover flaws in immobilizer encryption systems used in some Toyota, Hyundai, and Kia keys, letting attackers gain access with inexpensive hardware (Andy Greenberg/Wired)

Andy Greenberg / Wired:

Researchers discover flaws in immobilizer encryption systems used in some Toyota, Hyundai, and Kia keys, letting attackers gain access with inexpensive hardware — Encryption flaws in a common anti-theft feature expose vehicles from major manufacturers. — Over the past few years …

Fake Covid -19 gyaan goes viral

Mobile banking app Empower Finance just closed a $20 million Series A round

Another afternoon, another round of funding for a mobile banking app. This time, it’s Empower Finance a San Francisco-based company that’s headed up by former Sequoia Capital partner Warren Hogarth and which just closed on $20 million in Series A funding from Icon Ventures and Defy Ventures.

David Velez, who is the founder and CEO of Nubank, the largest fintech in Latin America, also joined the round.

We’d first written about the company in 2017, when Hogarth was just getting the business of the ground. Fast forward a bit and Empower now employs 35 people and has attracted more than 600,000 active users to its platform, says Hogarth. What has drawn them in: the company’s promise of combining AI and actual human financial planners to help millennials in particular accrue some wealth, including, more newly, through its own checking account product and through a savings account that’s currently promising 1.60% in annual percentage yield with no minimums, no overdraft fees, and unlimited withdrawals.

It’s all part of an overall offering that crunches through account holders’ bank and credit card accounts, and recommends how much they save into which account, how much they should spend given their overall picture, various ways they can cut costs and where, and when they’ve surpassed their pre-configured budgets.

Of course the company has so much competition it’s dizzying, but like the various upstarts against which it’s battling for mindshare, the opportunity that Empower is chasing is enormous, too. Though companies like Chime can seem overpriced given how fast investors have marked up their rounds — Chime’s newest financing, announced in December, was done at a $5.8 billion post-money valuation, which was four times more than the company was worth at the outset of 2019 — digital banks are still tiny fish in an ocean of institutional financial services, representing something like 3% of the market.

They’re gaining more market share by the day, too, including by charging far lower fees for much more.

In Empower’s case, users pay $6 a month, but Hogarth says they also save on $300 a year in additional fees they would pay a brick-and-mortar bank. He insists that on average, it also helps them save $1,300 more annually, too.

As for all those other companies — Mint, Acorns, the list goes on — Hogarth sounds surprisingly sanguine. “If you look at it from the outside, it looks crowded. But the consumer financial services in the U.S. is a $2 trillion business, and we haven’t had a fundamental shift since maybe Schwab came along 30 years ago.”

Indeed, says Hogarth, because Empower and its rivals are mobile and branchless and don’t have legacy software to contend with, they’re able to take 60 to 70 percent of the cost structure out of the business.

What that means on an individual company level is that even if they can attract 2 to 3 million customers, they can get to a multibillion-dollar market cap. At least, that kind of math is “why there’s so much interest in this space,” says Hogarth.

It’s also why people like Nubank’s Velez who’ve seen this story play out in Europe and Latin America and who are seeing the early phases of it in the U.S. are apparently keeping the money spigot open for now.

Empower had earlier raised an undisclosed amount of seed funding from Sequoia, followed by a $4.5 million round led by Initialized Capital.

Pex buys Dubset to build YouTube ContentID for TikTok & more

Social networks are in for a rude copyright awakening. A new European Union law called Article 17 essentially eradicates safe harbor and requires that they’ve made their “best effort” to get licenses from rights holders for all content on their platform. If a user uploads a video with a popular song in the background, tech platforms can’t just take it down if requested. They’ll be liable if they didn’t already try to get permission.

That’s good news for musicians and film producers who are more likely to get paid. But it could hurt influencers and creators whose clips and remixes might be blocked or have their revenue diverted. It will certainly be a huge headache for content sharing sites.

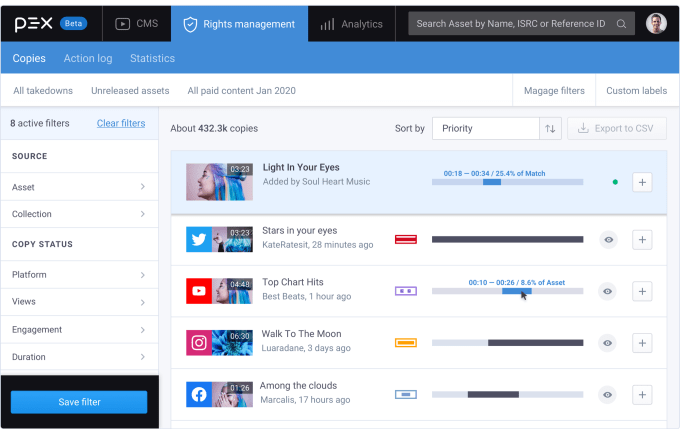

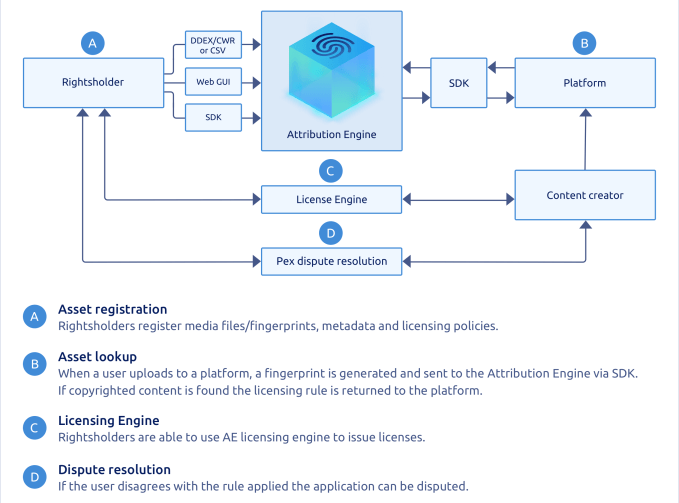

That’s where Pex comes in. The profitable royalty attribution startup founded in 2014 scans social networks and other user generated content sites for rightsholders’ content. Pex then lets them negotiate licensing with the platforms, request a take down, demand attribution, and/or track the consumption statistics. It’s collected a database of over 20 billion audio and video tracks found on YouTube, Facebook, Instagram, TikTok, Twitch, Twitter and more. It’s like an independent YouTube ContentID.

Today that business gets a big boost as Pex is acquiring Dubset, which has spent 10 years tackling the problem of getting remixes and multi-song DJ sets legalized for streaming on services like Spotify to some success. The $11.3 million-funded Dubset does fingerprinting of 45 million tracks from over 50,000 rights holders down to the second so the artists behind the source material get paid.

Pex has come a long way from when CEO Rasty Turek tried build a Shazam for video. “It took me years to figure out how to do it technically, but there was no market for it” he tells me. Turns out that the technology was perfect for spotting illegal usage of copyrighted songs.

Now Pex will gain Dubset’s connections to tons record labels and other rightsholders in what two sources close to the deal says is an acquisition priced between $25 million and $50 million. “There are very few companies in the music business that have successfully licensed as much catalog as Dubset, and the music rights database they’ve built is massive and rare” Pex CEO Rasty Turek tells TechCrunch exclusively before the deal’s formal announcement tomorrow.

Together, they’ll be pushing Pex’s new Attribution Engine that establishes a three-sided marketplace for content. Instead of just working with rightsholders, the fresh tech can plug directly into big platforms and instantly identify copyrighted audio and visual files as short as one second. It can even suss out cover versions of songs via melody matching, as well as compressed, cropped, and modified variations. Creators can also use it to ensure the source material they’re remixing or turning into memes is given proper attribution or a cut of revenue.

The Attribution Engine earns money by facilitating the licenses and payments between platforms, rightsholders, and creators. It’s free to register content with the service as well as for platforms to perform

The Attribution Engine is free for rightsholders to register their content and free for platforms to run identification scans on what’s uploaded to them. using our asset lookup service. The hope is that by creating a simpler path to cooperation and revenue sharing, more rightsholders will make their content accessible for use on social networks or in remixes. It could also grant platforms protection from Article 17 liability since they’ll be able to say that Pex made it best effort to get content usage approval from rights holders.

“Basically every platform in the world that operates in the EU will have to identify all copyrighted content on their platform as it comes in or go back and identify all of it” says Dubset chief strategy office Bob Barbiere. “Dubset was really built to serve at the DJ or content creator level . . . doing it purely for the purposes of mix and remix content. Pex does it in a much bigger way for the platforms.”

For up-and-coming platforms like TikTok competitors Dubsmash or Triller, Pex’s business model is a gift. They don’t have to pay for the ID service until they’re ready to cut licensing deals with rightsholders when Pex adds a fee on top. Trying to build this stuff from scratch could be slow and hugely expensive, given YouTube’s still perfecting its ContentID system eight years in.

Pex will have to manage the careful balance of staying ahead of regulation but not so far that it’s building technology people won’t need for a long time. European Union states have until June 21st 2021 to implement Article 17 with local laws. “We don’t want others to out-innovate us, but we also don’t want to out-innovate ourselves out of existence by being too early and then waiting for the market to catch up to us” Rasty explains.

Image via HelpCloud

The internet needs this kind of infrastructure because we’re still at the beginning of the age of the remix. TikTok has proven how recontextualizing a song or vocal track with new visuals can create chains of jokes and content that go massively viral. The app productizes the Harlem Shake phenomenon, whereby people promote their own takes on a piece of content, drawing attention to the original and all the other versions. But these webs of remixes could be severed if platforms and rightsholders can’t forge licensing agreements.

“I hope that thanks to Pex, 20 years from now people will not have to think about copyright” Turek concludes. “Any content they produce and distribute on the open internet will be automatically attributed to them and generate revenue if they so choose.” That could allow more people to turn their passion for creation into their profession, whether they’re building an app, writing a song, or remixing a song into a meme for an app.

Wednesday, March 4, 2020

Azure IoT and Cisco IoT form partnership to integrate Cisco Edge with Microsoft Azure IoT Hub, say the partnership will enable more edge computing scenarios (Kurt Mackie/Redmond Channel Partner)

Kurt Mackie / Redmond Channel Partner:

Azure IoT and Cisco IoT form partnership to integrate Cisco Edge with Microsoft Azure IoT Hub, say the partnership will enable more edge computing scenarios — Microsoft and Cisco this week announced the “seamless integration” of the two companies' Internet of Things (IoT) and cloud products, enabling more edge computing scenarios.

Sources: DoorDash lost around $450M in 2019 and is in talks to raise debt that would convert to equity when it goes public (Erin Griffith/New York Times)

Erin Griffith / New York Times:

Sources: DoorDash lost around $450M in 2019 and is in talks to raise debt that would convert to equity when it goes public — The food delivery app is losing money, battling rivals, facing lawsuits — and trying to go public. What could go wrong? — SAN FRANCISCO — DoorDash …

Twitter Tests Vanishing Tweets to Keep Up With Facebook, Snapchat

PE firm Everstone combines India's Wingify, which helps A/B test sites, and France's AB Tasty, which improves e-commerce UX; Everstone bought Wingify for $200M (Jagmeet Singh/TechCrunch)

Jagmeet Singh / TechCrunch : PE firm Everstone combines India's Wingify, which helps A/B test sites, and France's AB Tasty, which...

-

http://bit.ly/2XqNIDz

-

Amrith Ramkumar / Wall Street Journal : An interview with White House OSTP Director Michael Kratsios, a Peter Thiel protégé confirmed by ...