Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Sunday, March 1, 2020

Facebook to ramp up promotions in India

Indie game developers and publishers say Stadia's library is sparse because Google wasn't offering devs enough money and may abandon the platform in the future (Ben Gilbert/Business Insider)

Ben Gilbert / Business Insider:

Indie game developers and publishers say Stadia's library is sparse because Google wasn't offering devs enough money and may abandon the platform in the future — - Instead of having to buy games on a disc or download them from a digital store, Stadia users stream games over the internet …

Hyderabad-based hospitality firm files insolvency plea against Oyo

Oppo Reno 3 Pro to Launch in India Today: All You Need to Know

Kuo: iPhone production will not significantly improve before Q2, as suppliers like lens manufacturer Genius Electronic Optical struggle to keep up amid COVID-19 (Frank McShan/MacRumors)

Frank McShan / MacRumors:

Kuo: iPhone production will not significantly improve before Q2, as suppliers like lens manufacturer Genius Electronic Optical struggle to keep up amid COVID-19 — Apple's iPhone production will not significantly improve until the second quarter of 2020, according to a research note …

China Roundup: Apple closes a 4-year-old App Store loophole

Hello and welcome back to TechCrunch’s China Roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world. This week, Apple made some major moves that are telling of its increasingly compliant behavior in China where it has seen escalating competition, but investors are showing dissatisfaction with how it is approaching hot-button issues in the country.

Virus game gone

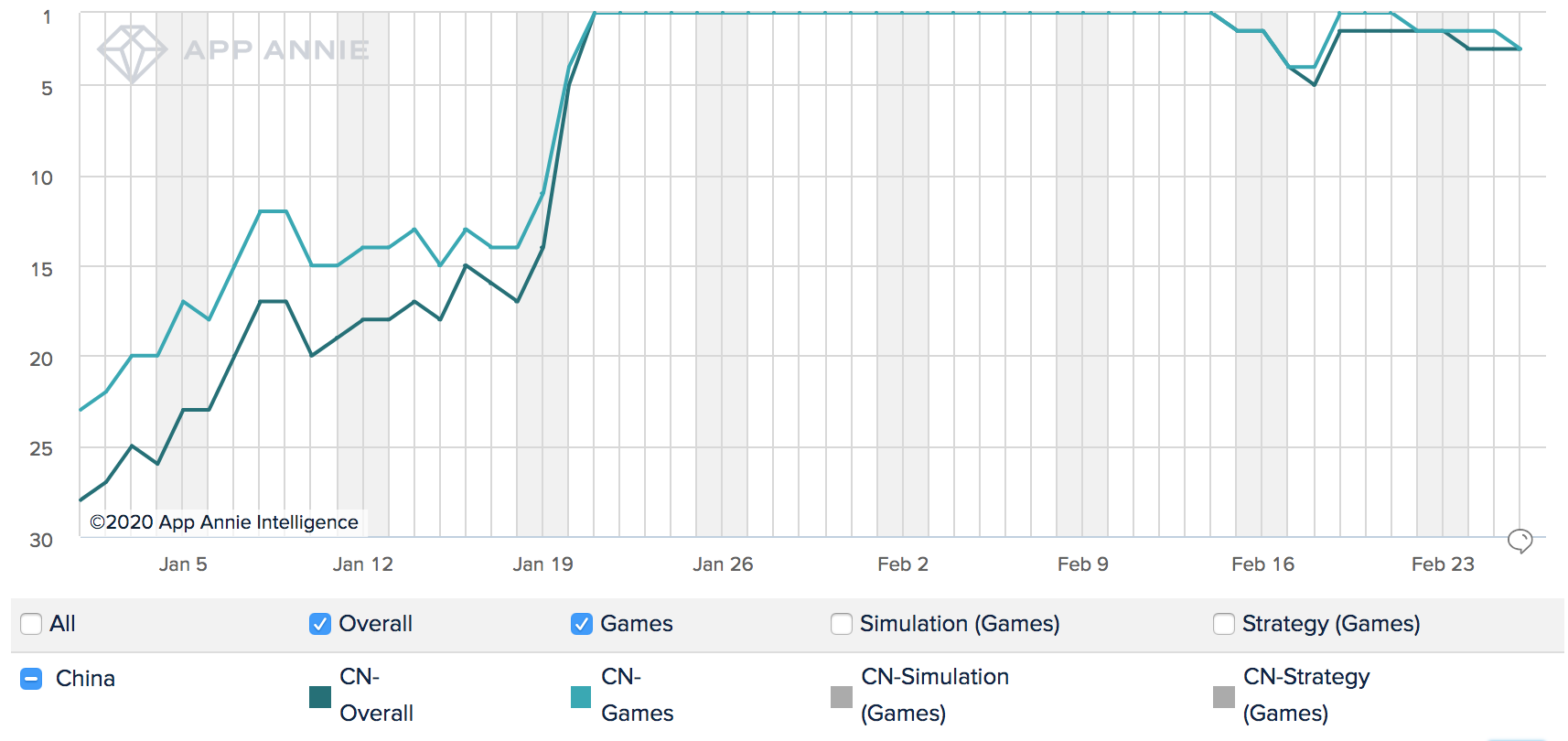

Plague Inc., a simulation game where a player’s goal is to infect the entire world with a deadly virus, was removed from the China iOS App Store this week. Since the outbreak of the COVID-19 coronavirus in late January, Chinese users had flocked to download the eight-year-old game, potentially seeking an alternative way to understand the epidemic.

Data from market research firm App Annie shows that the title remained the most downloaded app in China from late January through most of February, up from No. 28 at the beginning of the year.

Ndemic Creations, the U.K. studio behind the game, said in a statement that the “situation” — the removal of Plague Inc. from the Apple App Store — “is completely out of our control.” The Chinese government provided an opaque reason for the takedown, saying the game “includes content that is illegal in China as determined by the Cyberspace Administration of China,” which is the country’s internet watchdog.

The incident has gotten plenty of attention in and outside of China. Some speculate that Apple has caved to pressure from Beijing, which could find Plague Inc.’s gameplay troubling. One sticking point is that its tutorial by default picks China as the starting country, although in the main game a user can begin anywhere in the world. The Information reported in 2018 that Plague Inc. actually applied for official permission to distribute in China but was turned down on account of its “socially inappropriate” content.

Others including Niko Partners games analyst Daniel Ahmad suggested that the Chinese authority might have taken issue with a December version update that allowed players to create “fake news,” which could mislead them in seeking advice in the midst of the health crisis.

Ahmad also suggested that the ban might have been linked to the ongoing crackdown of unlicensed mobile games in China. Notably, the Plague Inc. ban coincided with Apple’s announcement this week that would require all games in its Chinese app store to obtain government approval in the form of an ISBN number beginning in July. Few details have come to light about what this new regulatory process entails. Nor do developers know whether currently published games without official approval will be removed.

Plague Inc, the popular simulation game where the goal is to infect everyone in the world with a deadly virus, has been removed from the iOS app store in China.

The Cyber Administration of China says the game included illegal content. No other specifics.https://t.co/73dNNJlgmX pic.twitter.com/lYqQ4TASeY

— Daniel Ahmad (@ZhugeEX) February 27, 2020

Apple investors are not sitting well with the firm’s app takedowns in China. 40% of its shareholders cast support for a proposal that would force Apple to uphold human rights commitment and be more transparent on how it responds to Beijing’s requests to censor apps.

Apple’s Delay

The gaming permit requirement is not new, though. In fact, Apple is just closing a regulatory loophole that had existed for years. Back in 2016, the Chinese government stipulated that video games — both PC and mobile — must apply for an ISBN number before entering circulation China. Within months, alternative Android stores operated by domestic tech giants swiftly moved to weed out illegal games. The official Google Play store is unavailable in China.

But Apple has managed to keep unlicensed titles in stock in the world’s largest gaming market, where content is strictly monitored. The American behemoth has many incentives to do so. Despite iPhone’s eroding share in China (to be fair, all Chinese phone makers but Huawei have recently suffered declining market share), iOS apps in China, especially games, remain an important revenue source for Apple.

So it’s in Apple’s best interest to clear hurdles for apps publishing in the country. Where there is a will, there is a way. Prior to 2016, publishing a game in China was relatively hassle-free. Following the regulatory change that year, Apple began asking games for proof of government license — but it didn’t go all out to enforce the policy. Local media reported that developers could get by with fabricated ISBN numbers or circumvent the rule by publishing in an overseas iOS App Store first and switching to China later.

This questionable practice did not go unnoticed. In August 2018, a Chinese state media lambasted Apple for its lousy oversight over App Store approvals.

Stepping up inspection on games will likely have little impact on China’s gaming titans who enjoy the financial and operational resources to secure the much-needed permit. Rather, their challenge is devising content that aligns with Beijing’s ideological guidelines, exemplified by Tencent’s patriotic makeover of PUBG.

Those that will be worst hit will most likely be small-time, independent studios, as well as firms that create “sockpuppet games” (马甲包), a practice whereby a developer exploits app stores’ loopholes to publish a troop of clones with similar gameplay and mask their appearance with altered names, logos and characters. Doing so can often help the publisher gain more traffic and revenue, but these sockpuppets will have a low chance of passing the authority’s strict scrutiny, which, as a Chinese gaming blog speculates, will potentially put an end to the surreptitious practice.

Making money from games: the future of virtual economies

Fictional portrayals of virtual worlds such as “Ready Player One” and “The Matrix” typically portray the physical and virtual worlds as distinct realms siloed from each other. Characters escape a dystopian, impoverished physical realm and enter a separate, utopian virtual realm in which they are wealthy and important.

Our non-fictional future won’t have that dichotomy. One main reason is money. Any virtual world has a virtual economy, and when that virtual economy gets really big, it integrates with our real-world economy. That is in equal parts due to market forces and government intervention.

This is part six of a seven-part series about “multiverse” virtual worlds. We will explore the dynamics of games’ virtual economies, the exchange of virtual assets for real money, challenges with money laundering and underage gambling, the compliance infrastructure needed for virtual economies, and the challenges in balancing a virtual economy’s monetary supply.

What separates virtual from “real” is the ability to make money

To many people, the idea of spending time in virtual worlds amassing in-game currency and trading goods still sounds like the geeky science fiction hobby of someone who needs to “get a real job.”

Our society gauges the worthiness of pursuits based on their social and economic productivity, and most people don’t view virtual worlds as productive places. As more people find enjoyment in virtual worlds and respect people with accomplishments in them, however, vying for accomplishment with those worlds will increasingly be viewed as socially productive. As more people start earning an income through work in virtual worlds, perception of economic productivity will quickly change, too.

Virtual worlds will be viewed as digital extensions of “the real world” and working a full-time job in a multiverse virtual world will become as normal as someone working in a social media marketing role today.

The Intuit-Credit Karma deal, driven by the latter's stash of user data, poses an important test case for US regulators' budding interest in data-driven mergers (Gilad Edelman/Wired)

Gilad Edelman / Wired:

The Intuit-Credit Karma deal, driven by the latter's stash of user data, poses an important test case for US regulators' budding interest in data-driven mergers — Antitrust regulators say they're interested in data-driven mergers. Intuit's $7 billion deal to buy Credit Karma will show how serious they are.

DTE Assam Recruitment 2020 – Apply Online for 312 Lecturer, Grade IV & Other Posts

Elementor, a WordPress-focused graphical website building platform, raises $15M from Lightspeed Venture Partners (Frederic Lardinois/TechCrunch)

Frederic Lardinois / TechCrunch:

Elementor, a WordPress-focused graphical website building platform, raises $15M from Lightspeed Venture Partners — WordPress has become so ubiquitous, it's easy to forget that it still drives a huge ecosystem of startups that build tools and services around the platform.

May we live in interesting times

It’s never a good sign when, in order to discuss the near future of technology, you first have to talk about epidemiology–but I’m afraid that’s where we’re at. A week ago I wrote “A pandemic is coming.” I am sorry to report, in case you hadn’t heard, events since have not exactly proved me wrong.

The best current estimates are that, absent draconian measures like China’s, the virus will infect 40-70% of the world’s adults over the next year or so. (To be extra clear, though, a very sizable majority of cases will be mild or asymptomatic.)

I've updated my thread on the 40-70% statement I made to @WSJ and @TheAtlantic. Tl;dr I'd now say likely 40-70% of adults (kids uncertain) unless very effective and long-lasting (thus burdensome) control measures can be sustained. https://t.co/lXSfl6VyUl

— Marc Lipsitch (@mlipsitch) February 26, 2020

This obviously leads to many questions. The most important is not “can we stop it from spreading?” The answer to that is already, clearly, no. The most important is “will its spread be fast or slow?” The difference is hugely important. To re-up this tweet/graph from last week:

The ultimate goal of such measures is to reduce the intensity of an outbreak, flattening out the epidemic curve and therefore reducing strain on the health system, and on social economic well-being (see this graphic representation). pic.twitter.com/fWOCq453Bx

— Josh Michaud (@joshmich) February 22, 2020

A curve which looks like a dramatic spike risks overloading health care systems, and making everything much worse, even though only a small percentage of the infected will need medical care. Fortunately, it seems likely (to me, at least) that nations with good health systems, strong social cohesion, and competent leadership will be able to push the curve down into a manageable “hill” distribution instead.

Unfortunately, if (like me) you happen to live in the richest country in the world, none of those three conditions apply. But let’s optimistically assume America’s sheer wealth helps it dodge the bad-case scenarios. What then?

Then we’re looking at a period measured in months during which the global supply chain is sputtering, and a significant fraction of the population is self-isolating. The former is already happening:

Port of Los Angeles is projecting a 25% drop in container volumes this month, as the economic impact of the coronavirus spreads across shipping operations and foreign supply chain. Imagine if 1 in 4 goods imported from Asia suddenly stopped coming. Impact just starting.

— Eric Lipton (@EricLiptonNYT) March 1, 2020

It’s hard to imagine us avoiding a recession in the face of simultaneous supply and demand shocks. (Furthermore, if the stock markets keep dropping a couple percent every time there’s another report of spreading Covid-19, we’ll be at Dow 300 and FTSE 75 in a month or two–I expect a steady, daily drip-feed of such news for some time. Presumably traders will eventually figure that out.) So what happens to technology, and the tech industry, then?

Some obvious conclusions: technology which aids and enables remote work / collaboration will see growth. Biotech and health tech will receive new attention. More generally, though, might this accelerate the pace of technological change around the world?

A little over a year ago I wrote a piece entitled “Here comes the downturn” (predicting “Late 2019 or early 2020, says the smart money.”) To quote, er, myself:

The theory goes: every industry is becoming a technology industry, and downturns only accelerate the process. It’s plausible. It’s uncomfortable, given how much real human suffering and dismay is implicit in the economic disruption from which we often benefit. And on the macro scale, in the long run, it’s even probably true. Every downturn is a meteor that hits the dinosaurs hardest, while we software-powered mammals escape the brunt.

Even if so, though, what’s good for the industry as a whole is going to be bad for a whole lot of individual companies. Enterprises will tighten their belts, and experimental initiatives with potential long-term value but no immediate bottom-line benefit will be among the first on the chopping block. Consumers will guard their wallets more carefully, and will be ever less likely to pay for your app and/or click on your ad. And everyone will deleverage and/or hoard their cash reserves like dragons, just in case.

None of that seems significantly less true of a recession caused by a physical shock rather than a mere economic one. My guess is it will be relatively short and sharp, and this time next year both pandemic and recession will essentially be behind us. In the interim, though, it seems very much as if we’re looking at one of the most disconcertingly interesting years in a very long time. Let’s hope it doesn’t get too much moreso.

Game Developer Conference 2020 postponed due to health concerns over Coronavirus outbreak

The Game Developer Conference has been postponed due to health concerns over the Coronavirus outbreak. Over the recent week, companies have dropped out from attending the conference and three weeks before the event was supposed to take place, it has now been postponed to an unspecified date. The event itself has not been cancelled but will be shifted to “later in the summer”.

A statement on the GDC website says, "After close consultation with our partners in the game development industry and community around the world, we’ve made the difficult decision to postpone the Game Developers Conference this March,". The show was scheduled for March 16 but companies such as Sony, Microsoft, EA, Epic, Unity, Activision Blizzard, and many more pulled out due to fears of the Cornovirus outbreak. Developers also skipped out on attending PAX East 2020 but that event is still taking place over this weekend.

This does not come as a surprise as the Coronavirus outbreak has also caused the cancellation of MWC earlier this year. Because of the severity of the outbreak, major events and smashed other global conferences have seen massive dropouts or outright cancellations. Who knows when this epidemic will subside but for now, it all seems up in the air.

Big Data promises better deals. But for whom?

Enlarge / Sasan Goodarzi, president and chief executive officer of Intuit Inc., left, and Kenneth Lin, co-fonder and chief executive officer of Credit Karma Inc., smile during a Bloomberg Television interview in San Francisco, California, on Tuesday, Feb. 25, 2020. Intuit—the software giant behind TurboTax—said Monday it's buying Credit Karma for about $7.1 billion in cash and stock. (credit: Bloomberg | Getty Images)

The announcement earlier this week that Intuit, the financial software giant, would be buying the personal finance company Credit Karma for $7 billion was striking. The tech industry is under more antitrust scrutiny than ever; just a few weeks ago, the Federal Trade Commission announced a broad inquiry into the past decade of acquisitions by the five biggest tech giants, with a focus on mergers that kill off budding rivals. This deal certainly raises that prospect: Intuit and Credit Karma compete on various fronts, and Intuit’s most recent federal filings named Credit Karma’s free tax-preparation software as a threat to its dominant offering, TurboTax. Intuit has said it will keep Credit Karma's service free, and probably needs to promise as much to regulators to get the deal approved.

But antitrust enforcers, whose core responsibility is to keep markets competitive and protect consumers, are not just watching for mergers that kill off rivals. They’re also starting to look more closely at how tech companies acquire and use data. And that seems to be the main event here. The companies themselves have suggested that a driving force behind the merger is Intuit wanting to get its hands on Credit Karma’s stash of user data. Which raises an important question: do consumers benefit from deals where the key asset being sold is their own personal information?

We’re talking about a lot of data here. Credit Karma, whose business is built around a free credit-monitoring app, boasts more than a hundred million users. While those people don’t pay to use Credit Karma, they do turn over their financial information, as well as the kinds of behavioral and location data that other companies, like Facebook and Google, track. The platform’s algorithms then help lenders micro target users with offers for credit cards, loans, and other financial products. Credit Karma gets a cut when users sign up.

Indian phone-maker Lava International says it has signed an agreement for a $90M investment over the next three years with Global Emerging Markets Group (Himanshi Lohchab/The Economic Times)

Himanshi Lohchab / The Economic Times:

Indian phone-maker Lava International says it has signed an agreement for a $90M investment over the next three years with Global Emerging Markets Group — GEM group will make the investment over the next 36 months for through a ‘Share Subscription Facility’ which will allow the company …

Electricians are flocking to regions around the US to build data centers, as AI shapes up to be an economy-bending force that creates boom towns (New York Times)

New York Times : Electricians are flocking to regions around the US to build data centers, as AI shapes up to be an economy-bending force...

-

Jake Offenhartz / Gothamist : Since October, the NYPD has deployed a quadruped robot called Spot to a handful of crime scenes and hostage...

-

Answers to common questions about PCMag.com http://bit.ly/2SyrjWu https://ift.tt/eA8V8J