Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Thursday, January 30, 2020

Apple, Broadcom ordered to pay $1.1 billion for patent infringement

Flipkart scouts for land to develop campus to house all its businesses

Amazon reports big earnings, crosses $1 trillion in value

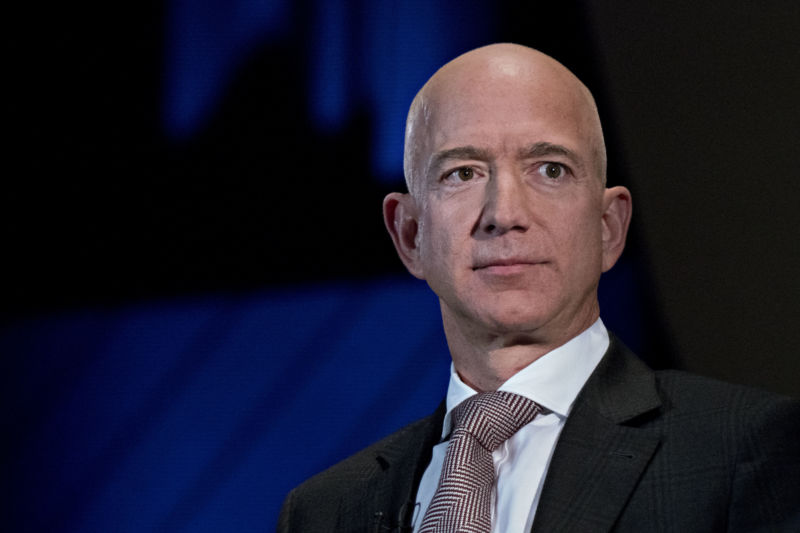

Enlarge / Jeff Bezos, founder and chief executive officer of Amazon.com Inc. (credit: Getty | Bloomberg)

Amazon delivered its final quarterly earnings report for the 2019 fiscal year today, and investor response to a largely positive report describing big holiday sales and AWS performance drove the company's market cap above $1 trillion.

Amazon told investors that it achieved $87.4 billion in revenue during the fourth quarter of its fiscal-year 2019.

This quarter included the holiday shopping frenzy, and Amazon impressed investors with a 21 percent increase in sales compared to the same quarter last year. Amazon executives said that the company quadrupled same-day and one-day shipping over last year's figures, and it credited part of the holiday success to the company's ability to offer expedient shipping. Achieving those speedy deliveries brought Amazon's shipping expenditures in the quarter up to $12.9 billion, more than 40 percent more than last year.

Survey of 12,043 US adults: 59% distrust Facebook for political and election news, including 62% of Republicans and 59% of Democrats, while 48% distrust Twitter (Danielle Abril/Fortune)

Danielle Abril / Fortune:

Survey of 12,043 US adults: 59% distrust Facebook for political and election news, including 62% of Republicans and 59% of Democrats, while 48% distrust Twitter — Facebook and Twitter are a long way from instilling confidence after letting misinformation flood their services during recent elections, according to a new survey.

Facebook takes down account of Jamia shooter

Govt to bundle over 4,000 free movies with internet to attract first time users

EA reports Q3 revenues of $1.98B, beating expectations, on growth of its live services to $993M, up 27% YoY; digital net income was $4.13B for 2019, up 15% YoY (Dean Takahashi/VentureBeat)

Dean Takahashi / VentureBeat:

EA reports Q3 revenues of $1.98B, beating expectations, on growth of its live services to $993M, up 27% YoY; digital net income was $4.13B for 2019, up 15% YoY — Electronic Arts reported earnings that beat Wall Street's expectations for the third fiscal quarter ended December 31 …

Google shows off far-flung A.I. research projects as calls for regulation mount (Jennifer Elias/CNBC)

Jennifer Elias / CNBC:

Google shows off far-flung A.I. research projects as calls for regulation mount — Google is working on several long-term artificial intelligence projects it hopes to launch widely someday. — Projects in advanced stages include real-time language translation and anemia detection.

Amazon quietly publishes its latest transparency report

Just as Amazon was basking in the news of a massive earnings win, the tech giant quietly published — as it always does — its latest transparency report, revealing a slight dip in the number of government demands for user data.

It’s a rarely seen decline in the number of demands received by a tech company during a year where almost every other tech giant — including Facebook, Google, Microsoft and Twitter — all saw an increase in the number of demands they receive. Only Apple reported a decline in the number of demands it received.

Amazon said it received 1,841 subpoenas, 440 search warrants and 114 other court orders for user data — such as its Echo and Fire devices — during the six-month period ending 2019.

That’s about a 4% decline on the first six months of the year.

The company’s cloud unit, Amazon Web Services, also saw a decline in the number of demands for data stored by customers, down by about 10%.

Amazon also said it received between 0 and 249 national security requests for both its consumer and cloud services (rules set out by the Justice Department only allow tech and telecom companies to report in ranges).

At the time of writing, Amazon has not yet updated its law enforcement requests page to list the latest report.

Amazon’s biannual transparency report is one of the lightest reads of any company’s figures across the tech industry. We previously reported on how Amazon’s transparency reports have purposefully become more vague over the years rather than clearer — bucking the industry trend. At just three pages, the company spends most of it explaining how it responds to each kind of legal demand rather than expanding on the numbers themselves.

The company’s Ring smart camera division, which has faced heavy criticism for its poor security practices and its cozy relationship with law enforcement, still hasn’t released its own data demand figures.

Wednesday, January 29, 2020

Source: Apple has terminated AI startup Xnor.ai's involvement in the Pentagon's Project Maven after its recent acquisition of the startup (The Information)

The Information:

Source: Apple has terminated AI startup Xnor.ai's involvement in the Pentagon's Project Maven after its recent acquisition of the startup — Big technology companies like Microsoft, Amazon and Google have jockeyed to secure lucrative contracts supplying their products and services to the military.

Realme India CEO Madhav Sheth Snapped Sporting Realme Fitness Band

Samsung Hit by Weakening Demand in Key Products in Q4

Facebook Climbs to 2.5 Billion Monthly Active Users in Q4

KPCB has already blown through much of the $600 million it raised last year

Kleiner Perkins, one of the most storied franchises in venture capital, has already invested much of the $600 million it raised last year and is now going back out to the market to raise its 19th fund, according to multiple sources.

The firm, which underwent a significant restructuring over the last two years, went on an investment tear over the course of 2019 as new partners went out to build up a new portfolio for the firm — almost of a whole cloth.

A spokesperson for KPCB declined to comment on the firm’s fundraising plans citing SEC regulations.

The quick turnaround for KPCB is indicative of a broader industry trend, which has investors pulling the trigger on term sheets for new startups in days rather than weeks.

Speaking onstage at the Upfront Summit, an event at the Rose Bowl in Pasadena, Calif. organized by the Los Angeles-based venture firm Upfront Ventures as a showcase for technology and investment talent in Southern California, venture investor Josh Kopelman spoke to the heightened pace of dealmaking at his own firm.

The founder of First Round Ventures said that the average time from first contact with a startup to drawing up a term sheet has collapsed from 90 days in 2004 to 9 days today.

Josh Kopelman of First Round Capital: we can look at every company we’ve ever funded, and learned that the time from first email/contact to term sheet has shrunk from 90 days in 2004 to just 9 today.

— Dan Primack (@danprimack) January 29, 2020

“This could also be due to changes in the competitive landscape … and there may be changes with First Round Capital itself,” says one investor. “It may have been once upon a time that they were looking at really early raw stuff… But, today, First Round is not really in the first round anymore. Companies are raising some angel money or Y Combinator money.”

At KPCB, the once-troubled firm has been buoyed by recent exits in companies like Beyond Meat, a deal spearheaded by the firm’s former partner Amol Deshpande (who now serves as the chief executive of Farmers Business Network) and Slack.

And its new partners are clearly angling to make names for themselves.

“KP used to be a small team doing hands-on company building. We’re moving away from being this institution with multiple products and really just focusing on early-stage venture capital,” Kleiner Perkins partner Ilya Fushman said when the firm announced its last fund.

Kleiner Perkins partner Ilya Fushman

“We went out to market to LPs. We got a lot of interest. We were significantly oversubscribed,” Fushman said of the firm’s raise at the time.

In some ways, it’s likely the kind of rejuvenation that John Doerr was hoping for when he approached Social + Capital’s Chamath Palihapitiya about “acquiring” that upstart firm back in 2015.

At the time, as Fortune reported, Palihapitiya and the other Social + Capital partners, Ted Maidenberg and Mamoon Hamid would have become partners in the venture firm under the terms of the proposed deal.

Instead, Social + Capital walked away, the firm eventually imploded and Hamid joined Kleiner Perkins two years later.

The new Kleiner Perkins is a much more streamlined operation. Gone are the sidecar and thematic funds that were a hallmark of earlier strategies and gone too are the superstars brought in by Mary Meeker to manage Kleiner Perkins’ growth equity investments. Meeker absconded with much of that late stage investment team to form Bond — and subsequently raised hundreds of millions of dollars herself.

Those strategies have been replaced by a clutch of young investors and seasoned Kleiner veterans including Ted Schlein who has long been an expert in enterprise software and security.

“Maybe at this point they think they can raise based on the whole story about Mamoon taking over and a few years from now they won’t be able to raise on that story and will have to raise on the results,” says one investor with knowledge of the industry. “Mamoon is a pretty legit, good investor. But the legacy of the firm is going to be tough to overcome.”

All of these changes are not necessarily sitting well with limited partners.

“LPs are not really happy about what’s going on,” says one investor with knowledge of the venture space. “Everybody thinks valuations are too high since 2011 and people are thinking there’s going to be a recession. LPs think funds are coming back to market too fast and they’re being greedy and there’s not enough vintage diversification but LPs … feel almost obligated that they have to do these things… Investing in Sequoia is like that saying that you don’t get fired for buying IBM.”

Retailers, hoteliers may soon run cloud kitchens

Sources: after five Thinking Machines staff left, investors are rattled, potentially impacting fundraising; two researchers quit via Slack during an all-hands (The Information)

The Information : Sources: after five Thinking Machines staff left, investors are rattled, potentially impacting fundraising; two researc...

-

http://bit.ly/2XqNIDz

-

Amrith Ramkumar / Wall Street Journal : An interview with White House OSTP Director Michael Kratsios, a Peter Thiel protégé confirmed by ...