Nico Grant / Bloomberg:

HP Inc. says it plans to cut 7,000 to 9,000 positions, or as much as 16% of its workforce, as it prepares for a CEO transition in November — - Fiscal 2020 adjusted profit to be $2.22 to $2.32 per share — PC giant boosts share buybacks by $5 billion, dividend by 10%

Tech Nuggets with Technology: This Blog provides you the content regarding the latest technology which includes gadjets,softwares,laptops,mobiles etc

Thursday, October 3, 2019

HP Inc. says it plans to cut 7,000 to 9,000 positions, or as much as 16% of its workforce, as it prepares for a CEO transition in November (Nico Grant/Bloomberg)

StrattyX lets you buy and sell shares using automated rules

StrattyX is a trading interface that lets you set up sophisticated “if-this-then-that” rules and execute orders on the stock market. The startup is participating in the Startup Battlefield at TechCrunch Disrupt SF.

There are plenty of brokers that let you buy and sell shares using a mobile app and a web interface. But if you want to access more sophisticated tools and automate strategies, there’s not much you can do.

StrattyX wants to open up automated trading software to anyone, from non-professional traders who have some savings to professional day traders. The startup focuses on this specific part of the process.

It doesn’t try to reinvent the wheel and it doesn’t want to become an online stock broker. Instead, the company integrates with existing brokers, such as Robinhood, TD Ameritrade and many others as long as they support trading via an API. It acts as an interface and executes orders on your behalf.

You can create rules based on multiple different factors. In addition to traditional stop-loss and stop-limit orders, you can say that you want to buy or sell shares if something happens on Twitter, in the news or on the stock market.

Here are a few examples of rules you can create:

- If @realdonaldtrump tweets something that contains “China” or “tariff,” sell Apple shares.

- If the value of EUR drops by 2% against USD, buy LVMH shares.

- If news headline contains “Tesla delays deliveries,” sell Tesla shares.

Interestingly, StrattyX will provide a marketplace of strategies. If a star investor starts using StrattyX to define a set of automated rules, other users could follow the same strategy.

StrattyX then wants to go one step further by giving you the tools to train a model using machine learning and user-generated data sets. You could imagine a feature that lets you upload a .csv file with price history and different types of data points, such as SEC filings, earnings, etc.

The company is also working on a feature that would show you news headlines that you’d rate with a Tinder-style swipe gesture — swipe right if you think it’s good news, swipe left if you think it’s bad news.

StrattyX is launching its mobile app today. It’s a sort of minimum viable product for now — some features are still in beta. The company is also working on a desktop version that would be useful for professional traders in particular.

StrattyX initially costs $5 per month per user, with more expensive plans for bigger teams and whether you execute a lot of orders through the product. The startup is looking to raise a seed round in the coming months.

Startups ‘are staying private way too long’ says Salesforce founder Marc Benioff

“What public markets do is indeed the great reckoning. But it cleanses [a] company of all of the bad stuff that they have.”

That’s Salesforce founder and chief executive officer Marc Benioff talking about the benefits of public markets.

It’s something that private companies seem to be ignoring in the go-go days of the current venture capital boom cycle and something that’s led to a lot of the erosion in investor value, says Benioff.

“I think in a lot of private companies these days, we’re seeing governance issues all over the place,” says Benioff.

The multi-billionaire founder of one of the most successful enterprise software companies of the past 20 years pointed to both WeWork and Uber as companies that could have benefitted from the oversight that public investors provide sooner in their lifecycle.

“I can’t believe this is the way they were running internally in all of these cases,” says Benioff. “They are staying private way too long.”

Benioff pointed to Salesforce as an example. “We went public, were $100 million in revenue [and] that was about the right time. We were small enough that we could make those changes and adjustments,” Benioff said. “And there’s a lot of those that have to continually happen, and that includes the people on your team… who are really keeping you on the straight and narrow.”

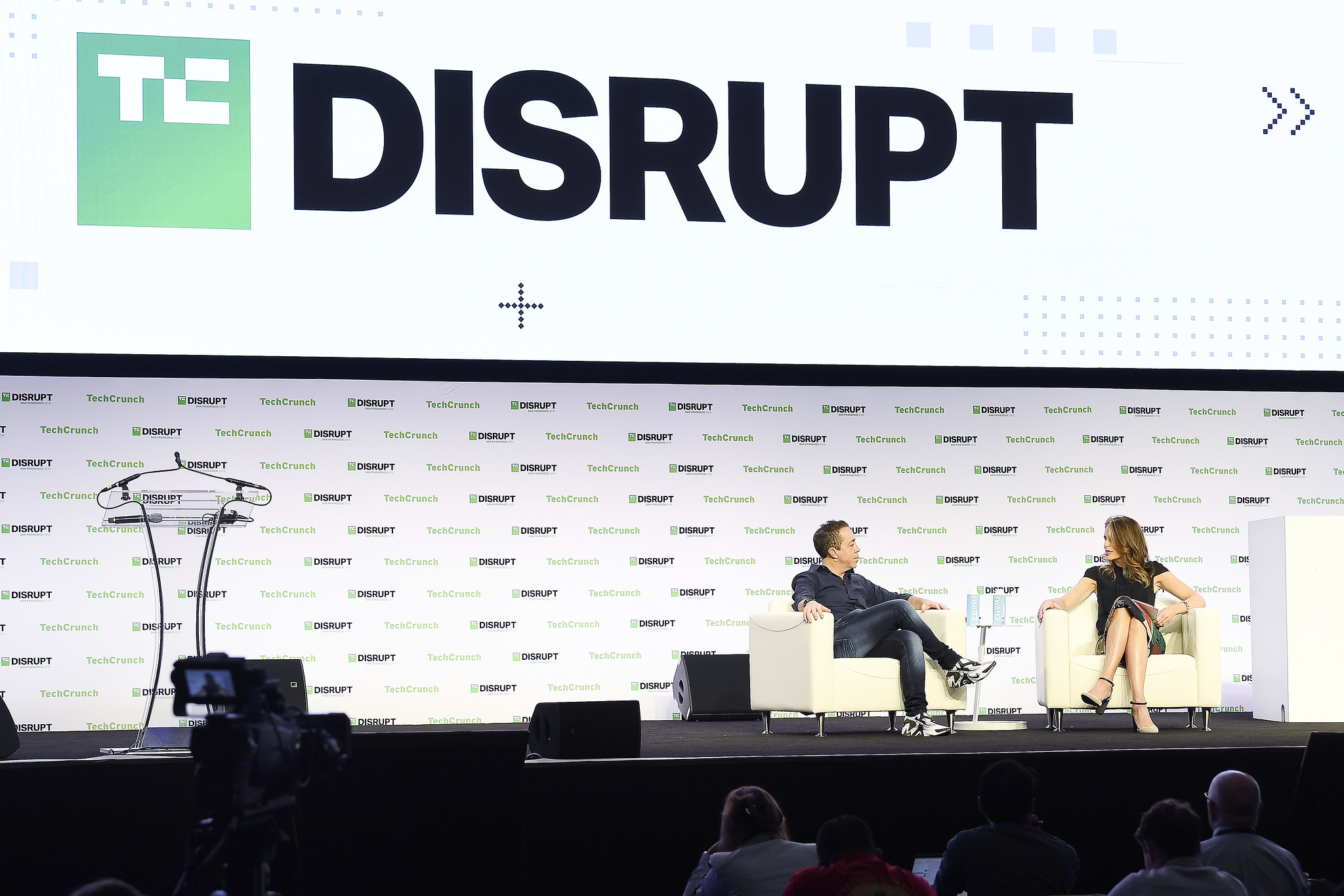

Benioff’s advocacy for public markets was just one facet of a wide-ranging interview onstage at our Disrupt SF event.

In addition to his old refrain that “Facebook should be regulated like cigarettes,” Benioff called for the creation of a national privacy policy to ensure that companies and consumers can be on the same page.

“We need a national privacy law,” he said. “Otherwise you’re going to get a patchwork of privacy laws. We have to get our privacy and data locked down so we know where we’re going. [Regulators] need to be stepping in now and they should be working hard to make those changes.”

Benioff also pointed to the need for a reinvention of modern capitalism and a rethinking of how executives build their startups if they want to be successful in the new business landscape of the early 21st century.

“I really strongly believe that capitalism as we know it is dead… that we’re going to see a new kind of capitalism and that new kind of capitalism that’s going to emerge is not the Milton Friedman capitalism that’s just about making money,” said Benioff. “And if your orientation is just about making money, I don’t think you’re going to hang out very long as a CEO or a founder of a company.”

LifeCouple wants to improve your romantic relationship

Good relationships require ongoing commitment and work. LifeCouple, launching today in public beta at TechCrunch Disrupt SF Startup Battlefield, wants to help make that work a bit easier for you and your partner.

Through its app, LifeCouple enables couples to address and monitor any challenges in their relationship. The startup does this by serving up content designed to encourage people to look more closely at their relationship across four key areas: trust, communication, conflict and intimacy. The content includes daily relationship challenges, ice breakers to help approach tricky conversations, digital gifts and more.

LifeCouple is designed to supplement couples therapy, its founder Sean Rones told TechCrunch.

“It’s not a replacement to therapy but it’s a complement to it,” he said. “I don’t think this can 100% solve your problem but it can give you the tools to solve your problems.”

Additionally, Rones envisions couples therapists using this tool to further assist their clients.

Just how startups use technology to track fitness and health, LifeCouple aims to help people create relationship goals, address those goals and track them over time. The ideal is for people to spend about 15 minutes per day to get the most out of it, Rones said.

[gallery ids="1888063,1888064,1888059,1888060,1888061,1888062"]

“What motivated me is after many different startups, I’ve learned that in order to be somewhat successful, you have to be tackling a really big problem,” he said.

LifeCouple is currently free, but is working to determine the cost moving forward. In the first two months of its soft launch, LifeCouple amassed 2,500 users in the U.S.

“What we’re trying to do is create something that can help — even if it’s just 10 couples that stay together,” Rones said.

This year, LifeCouple raised a $575,000 seed round. The plan is to do a full launch in January.

CEO David Krane suggests GV could sell the rest of its Uber stake at the end of its lockup period next month

Today at TC’s Disrupt show in San Francisco, we took the stage with David Krane, a longtime veteran of Google who took the reins as the CEO of its venture arm, GV, three years ago but hasn’t spoken publicly since. We asked him why he’s been in hiding before diving into some questions about Uber — whose $250 million Series C round in 2013 was somewhat famously funded entirely by GV — and trying to understand better how GV is organized under his leadership.

Krane, who earlier in his career was Google’s global head of PR, is accustomed to deflecting reporters’ questions and he was circumspect about some things, but he did let drop some interesting information. For example, he told us that GV has plugged a whopping $5 billion into startups since it was formed 10 years ago. Krane also joked that Alphabet’s famous founders don’t steer entirely clear of the organization. And he suggested that GV — which sold a meaningful part of its Uber stake to SoftBank last year — might sell the rest of its Uber stake when the ride-share company’s lock-up period expires in November. (His team has a “decision to make,” he said.)

Following is some of our chat, edited lightly for length and clarity:

TC: It’s been three years since you took the role of CEO. Why has it taken you so long to come out of hiding?

DK: Well, I haven’t been in hiding, I’ll tell you that we’ve been really busy. When you have a second act at Google, which is remarkably different from your first act, you actually kind of have to stay focused on that. So we’ve been busy building an extremely large scale venture firm, which this year is celebrating our 10th birthday. And I’ve been doing that [from its outset].

TC: There’s a lot to chat about. Let’s talk quickly about one of your highest-profile deals, which was investing in Uber. I’ve long heard that you are the one who was agitating to lead this $250 million dollar Series C round, which, at the time, was a very big deal. It was also a brilliant investment. Do you think Uber is also a good investment now for public shareholders?

DK: This is a special company. This company has an unmistakable brand. It operates in countries around the world. It has scaled, it ha a moat around it, it’s touched by almost no one in the category. So honestly, we’re long term. We’re bullish on this. And I think it is an interesting investment opportunity. And it happens to be on sale today.

TC: It’s obviously getting into new business lines, which is interesting. But you’d also told me that GV had sold part at stake to SoftBank last year, when the the conglomerate came in and wanted to buy up a substantial percentage of the company. Can you say how much of your stake you sold?

DK: It’s probably best not to, but I’d say it was a great transaction. Working with SoftBank was quite pleasant. And I think there were a number of shareholders that did [the same].

TC: Uber’s lockup period is coming up quickly. Will you sell the rest of your stake?

DK: I think it’s not clear yet, to be hones with you. We’re paying attention to the market, which is a bit unstable, to say the least. But yeah, in about a month, we’re going to have a decision to make.

SAN FRANCISCO, CALIFORNIA – OCTOBER 03: (L-R) GV CEO & Managing Partner David Krane speak and TechCrunch Silicon Valley Editor Connie Loizos onstage during TechCrunch Disrupt San Francisco 2019 at Moscone Convention Center on October 03, 2019 in San Francisco, California. (Photo by Steve Jennings/Getty Images for TechCrunch)

TC: When you invested in Uber in 2013, you were investing in a different founder: Travis Kalanick, who was pressured to resign in 2017. It’s a little bit reminiscent of what happened with Adam Neumann of WeWork, who had grown the company over the last nine years and was last week pressured to resign.

Are we in agreement that maybe the investors could have done something sooner? These are two founders whose management styles were very well-known.Why suddenly, was it problematic? And why didn’t someone do something sooner?

DK Well, probably the best advice that I could offer there is it would have been prudent to curb some of Adam’s creativity little bit sooner. . . . But there’s very little similarity between Travis and Adam. Travis is a founder that in his peak at Uber was incredibly enviable, and someone that we chased very aggressively to try and be involved with.

TC: Let’s talk about GV. I think we all want to know more about GV under David Krane. One thing that I noticed is that in the firm’s early days, it would about these discrete pools of capital it was investing. One year, it was ‘We’ve raised $300 million.’ The next it was ‘We’ve been allocated $500 million.’ Is is still the case that you’re getting these yearly allocations? And if so, what are you investing right now?

DK: When we started GV, we had the opportunity to look at several decades of venture capital experience and pick some of the greatest attributes and to do our best to steer away from some things that weren’t optimized. So one of the things that we set up structurally was that yes, we would engage with our single [investor], Alphabet, and figure out what’s a reasonable pool of capital that our team could deploy each year. When we started 10 years ago, we started with literally a $50 million fund. Now 10 years later, we’re investing many hundreds of millions per year.

TC: How much has been allocated [to startups] altogether to this point?

DK: Total? We’re looking after nearly $5 billion.

TC: That’s astonishing. It’s not like Alphabet needs the money, but you did in invest in Uber — good for you. You invested in Nest Labs, which Google bought for $3.2 billion a few years ago. Can you talk about your returns? What percentage of that money has come back to Alphabet?

David Krane, CEO & managing partner of GV, at TechCrunch Disrupt SF 2019 on October 3, 2019

DK: As you know, this is a business often measured in decades. We’re 10 years old this year. And I’ll tell you, kind of directionally, that we’re incredibly happy with the financial performance of the fund. I will say, we’re backed by an investor that has a lot of bravery that puts its shoulder into risk and often tells us, ‘Do something more complex’ ‘Do something more crazy next time.’ I mean, it wouldn’t be unimaginable that [cofounder] Sergey ]Brin] would walk in and say, ‘Why don’t you do the space elevator next time?’ So sometimes those sorts of businesses may take a lot longer to return. But all in all, we’re incredibly happy with what we’ve returned so far.

TC: When I interviewed your predecessor, Bill Maris, a few years ago, he told me that every decision felt to him and him alone, following what were wide-ranging discussions with the staff whose opinions factored in heavily. But he said, that ultimately, GV is “not like a democracy in any way.” Are you the ultimate arbiter of what gets funded now at GV?

DK: I would say, technically speaking, we don’t run remarkably differently. That said, our success, and really, the excitement that we bring every day, is really playing a meaningful ‘meta’ team ball. So the experience for the entrepreneur is not so unusual [than] going to any other Sand Hill pitch room, where the entrepreneur would come in and spend an hour or two with us, we would have a dialogue afterwards, we would take some data, we would consult some data, and a discussion with sort of ensue.

Technically, yeah, I can come in and have a little bit of influence on what’s happening. But because we’re scaling what we’re doing, my objective as often as I can is to green-light as many investments as make sense.

TC: How many investments are you green-lighting here?

DK: I think this year we’ll do 100 deals, in total, in 10 years, we have an active portfolio of more than 300 companies. And I think if memory serves me correctly, we’ve done over 600 deals in 10 years.

TC: How many people are in staff at this point?

DK: Ninety people full time.

TC: It seems like there’s been more focus on elevating women through the ranks.

DK: Absolutely, it’s a big focus for us. We usea page out of the Google playbook that has served the company incredibly well for goal setting and product and engineering called OKRs, for objectives and key results. And we learned that OKRs are actually extensible to diversity and inclusion. So we set some goals a couple of years ago to, most importantly, go out to the market with more focus and do our best to fund a meaningful number of new and underrepresented founders. And I’d say in the last 18 months, we’ve deployed about $200 billion into underrepresented founders.

And conversely, we’ve used that same framework to improve the diversity of our team as well. And I think we’ve made some great progress there.

TC: Is the sort of compensation structure within GV the same as with traditional venture funds with management fees and Kara carry involved?

DK: We have a single LP, that’s probably one of the most distinctive attributes. But we’re set up mostly like Sand Hill firms, so we have access to all kinds of opportunities to run the business, with carry on our outcomes, [so] all interests are aligned. So it’s a really attractive place to be able to do venture.

TC: When Google formed this unit, 10 years ago, there was also a lot of talk about the data driven nature of investing that you would do. So can you tell me a little bit about the algorithms that you’re relying on and how they help you identify promising companies?

DK: I don’t think it would be Google Ventures without putting some emphasis on the Google part of that name. So using data machine learning has been something that’s very common in our practice for many years. We’ve got a team of something on the order of a dozen [to] focus on technology and how technology can frankly make humans smarter — and we don’t think it’s an either or, we think it’s an and. So we look at technology as an opportunity to analyze deals, discover new opportunities, but really, most importantly, to look at the portfolio at large and ensure that we’ve got the right exposure, we’ve got the right balance, to do our best to capture industry leading returns.

TC: Have you ever gone rogue and defied the data?

DK: We go rogue all the time, Data is there to help us It’s there to make us smarter. But it doesn’t singularly dictate what we do in terms of investment decisions.

TC: What are some of examples of [deals you’ve led that contradicted] the data?

DK: So An example would be a follow-on investment in a company. There may be some some tension between how the data signal will present its view, how other attributes may be more important. And it’s important for us to continue to show support to an entrepreneur, which we try to do as often as we can.

David Krane, CEO & managing partner of GV, at TechCrunch Disrupt SF 2019 on October 3, 2019

TC: You also have a big team here. You also have a team in Europe, but it seems like you’re predominantly still doing venture in the U.S.. Is that accurate?

DK: That’s correct. Yeah, most of our team is situated in a set of offices across the U.S. We’ve got a small team in London, Most of the dollars we invest go into U.S.-based companies and a wide variety of sectors. We do some investing in Europe. We don’t invest in Asia. We don’t invest in Latin America.

TC: Which is so interesting, especially Asia, given there’s so much going on there. In fact, you had told me that you’d invested in a company as a called FreshToHome that’s trying to tackle the fragmented perishable goods market in India.

How much personal investing do you do outside of GV and also, if that company takes off, is there a risk that Larry or Sergey would say, ‘Hey, David, why aren’t we in that deal?’

DK: Well, there’s certainly a chance if that company breaks out and we choose to expand our scope to investing in India that GV could look at it, no question about it. Today, we don’t have plans to invest there. So in markets where GV isn’t investing, we’re happy to support our partners’ personal interests,

I do a little bit of personal investing in categories that honestly have nothing to do with the main line of GV. I invested in a men’s outdoor professional lacrosse League, for example, called PLL, that’s probably not something that GV would do but it’s an area of passion for me; my children play lacrosse.

TC: Why not Asia, though?

DK: I think it’s inevitable that over time as we evolve, will consider taking on a new geography, but focus again, is a feature for our business, too. And I think we have a lot more opportunity to continue to further establish ourselves here.

TC: Shifting gears, let’s talk about bigger-picture stuff. We talked a little bit about Uber. You think Uber is still on sale and an attractive investment; obviously, some people disagree, we’ll see what happens with that company. But more broadly, are companies staying private too long?

DK: No. It’s interesting. There is so much capital in the market right now that there isn’t the burden to put oneself in a position that’s remarkably different from the control, the privacy, that one has is private. So it’s very company specific, your question, but I’d say in general, the market has changed so meaningfully in the last two years that there isn’t that pressure to seek capital in the public markets. You have many, many options to stay private. And for lots of companies, that’s a good thing.

TC: But is it good for Americans? So much wealth has been created before these companies go out, as with Uber, that once they go public, there’s not huge upside [for public market investors]. Taking yourself out of GV, does this [point] resonate at all?

DK: It resonates to some degree. Entrepreneurship is certainly one of the growth factors in this economy. And so we want to see it thrive. We want to see people in the public markets have an opportunity to experience growth and ride the evolution of these companies. But again, I think it’s really a very company specific question.

TC: What about direct listings, which seem to be top of mind, thanks to a confab organized earlier this week by VCs Bill Gurley and Mike Moritz. Since these aren’t fundraising events for companies, it’s hard for me to see these being widely adopted but what do you think?

DK: I think we heard on the stage yesterday from the founder of Slack that direct listings are not quite as clear as some of the benefits have been presented. As you noted, the company doesn’t always get capital. But I think there’s a lot of thinking right now about how to do a direct listing [to] ensure that employees and shareholders on the cap table can get some liquidity, but the company can also seek financing as well.

We were very fortunate to be part of Slack’s direct listing [and] had a great outcome with that. And as an investor, it’s great not to have a lock-up one day one.

TC: But do you think they’ll they’ll pick up momentum or will these be relegated to very special companies?

DK: I think directionally, there’s a huge opportunity to continue to innovate and enhance on on many aspects of how companies [obtain] liquidity. I think they’re promising but we need [more] examples of them. I think it’s a little bit early to tell.

TC: Before you go, there’s a lot of talk about regulating your parent company. Should it be broken up?

DK: I’ve read the same fear and and focused news articles that you have about this topic. I would say honestly, I’ve been a Google 20 years, It lives inside my veins. I’m very proud of what the company has built. I’m proud to have played a part of that. But I’d say for the last 10 years, having focused on venture capital, I’m really not the most authoritative expert in how Google should think about those sorts of issues. So I’m actually going to take a pass on that one, because we’re focused on something totally different.

TC: Okay. Do you think Facebook should be regulated?

DK: [Laughs.] We can if you like. You know, these are companies that do have a lot of power, they do have a lot of control. But also, the sum of those pieces can be very valuable for consumers and for partners as well. So again, these are these are big, complicated questions. I think these companies will have a lot of questions to answer in the coming months, and we’ll see what happens.

Wednesday, October 2, 2019

UPSSSC Answer Key 2019 – Combined Lower Subordinate Services Answer Key & Objections

UPSSSC 2019 – Combined Lower Subordinate Services Answer Key & Objections Released

Microsoft Showcases Surface Duo With Two 5.6-Inch Screens, Android

Google Offers Incognito Mode for Maps in Privacy Push

Sources: Uber to launch Uber Works, a new app on Friday in Chicago that will match temporary workers looking for shift work with businesses looking for staffing (Financial Times)

Financial Times:

Sources: Uber to launch Uber Works, a new app on Friday in Chicago that will match temporary workers looking for shift work with businesses looking for staffing — Uber is launching a new app on Friday in Chicago that will match temporary workers looking for shift work with businesses looking …

ETtech Top 5: Udaan valuation zooms, Political parties bullish on Facebook ads & more

India-based Udaan, which operates a B2B marketplace, says it has closed $585M Series D from Tencent and other investors; source says at $2.3B-$2.7B valuation (Manish Singh/TechCrunch)

Manish Singh / TechCrunch:

India-based Udaan, which operates a B2B marketplace, says it has closed $585M Series D from Tencent and other investors; source says at $2.3B-$2.7B valuation — Udaan, a three-year-old business-to-business e-commerce platform in India, has raised more than half a billion dollars …

Apple's 1st own India outlet to come up at Mumbai's Maker Maxity Mall

Offline phone retailers demand discounts in line with E-commerce platforms

How to connect to Wi-Fi and Bluetooth easily on Apple iPhone

What to expect in 2025: increased hype around AI agents, new generative AI-powered gadgets, better weather forecasts due to Google DeepMind's GenCast, and more (Wall Street Journal)

Wall Street Journal : What to expect in 2025: increased hype around AI agents, new generative AI-powered gadgets, better weather forecast...

-

Jake Offenhartz / Gothamist : Since October, the NYPD has deployed a quadruped robot called Spot to a handful of crime scenes and hostage...

-

Answers to common questions about PCMag.com http://bit.ly/2SyrjWu https://ift.tt/eA8V8J