Startups are often associated with the benefits and toys provided in their offices. Foosball tables! Free food! Dog friendly! But what if the future of startups was less about physical office space and more about remote-first work environments? What if, in fact, the most compelling aspect of a startup work environment is that the employees don’t have to go to one?

A remote-first company model has been Seeq’s strategy since our founding in 2013. We have raised $35 million and grown to more than 100 employees around the globe. Remote-first is clearly working for us and may be the best model for other software companies as well.

So, who is Seeq and what’s been the key to making the remote-first model work for us? And why did we do it in the first place?

Seeq is a remote-first startup – i.e. it was founded with the intention of not having a physical headquarters or offices, and still operates that way – that is developing an advanced analytics application that enables process engineers and subject matter experts in oil & gas, pharmaceuticals, utilities, and other process manufacturing industries to investigate and publish insights from the massive amounts of sensor data they generate and store.

To succeed, we needed to build a team quickly with two skill sets: 1) software development expertise, including machine learning, AI, data visualization, open source, agile development processes, cloud, etc. and 2) deep domain expertise in the industries we target.

Which means there is no one location where we can hire all the employees we need: Silicon Valley for software, Houston for oil & gas, New Jersey for fine chemicals, Seattle for cloud expertise, water utilities across the country, and so forth. But being remote-first has made recruiting and hiring these high-demand roles easier much easier than if we were collocated.

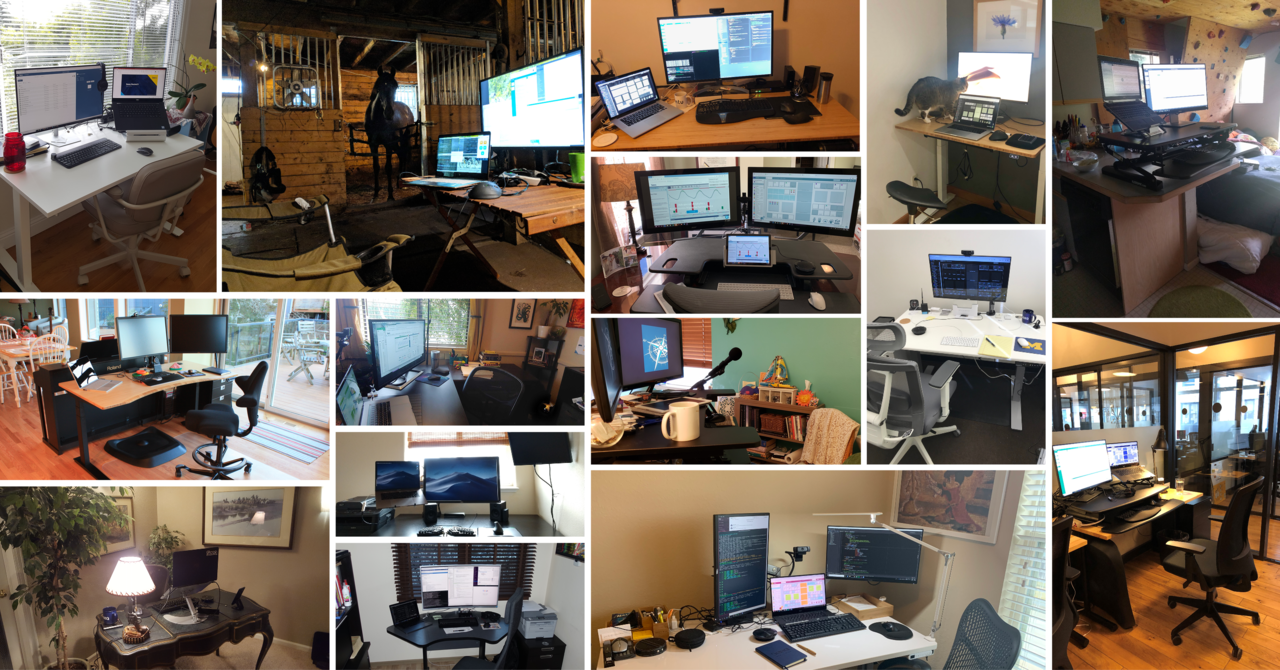

Image via Seeq Corporation

Job postings on remote-specific web sites like FlexJobs, Remote.co and Remote OK typically draw hundreds of applicants in a matter of days. This enables Seeq to hire great employees who might not call Seattle, Houston or Silicon Valley home – and is particularly attractive to employees with location-dependent spouses or employees who simply want to work where they want to live.

But a remote-first strategy and hiring quality employees for the skills you need is not enough: succeeding as a remote-first company requires a plan and execution around the “3 C’s of remote-first”.